Tennessee Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

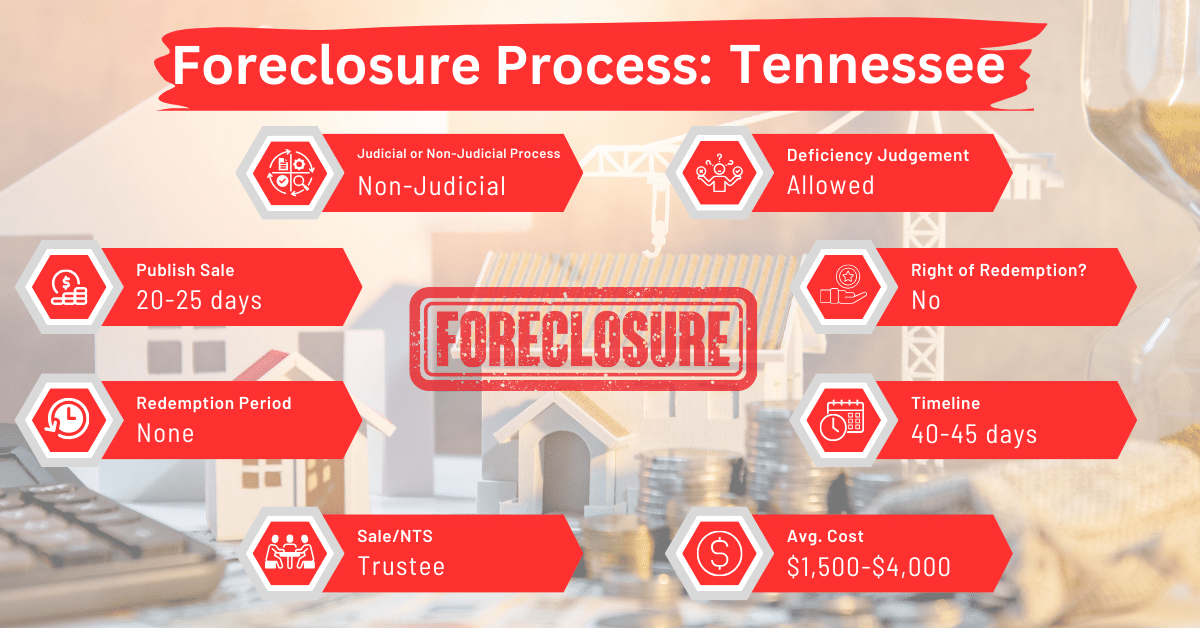

Most foreclosures in Tennessee are non-judicial. This means that they occur outside of the court system. They usually take about 40 to 45 days, which is shorter compared to many other non-judicial foreclosure states like Alabama, Arizona, Alaska, California, Colorado, Nevada, New Hampshire, North Carolina, and Utah.

Foreclosure Process Overview

In Tennessee, a borrower is at risk of foreclosure when they default on their mortgage payments. The lender relies on the power of sale clause in the mortgage or deed of trust to initiate foreclosure by selling the property to recover the unpaid loan amount.

Pre-foreclosure Period

During the pre-foreclosure period in Tennessee, the borrower may stop the foreclosure process by paying the total amount owed, including any applicable fees.

Types of Foreclosures

In Tennessee, non-judicial foreclosures are more common because many mortgages include power-of-sale clauses. Such provisions authorize the lender to sell the mortgaged property if the borrower defaults on repaying their loan.

Court foreclosures are rare in Tennessee. They only occur if the mortgage specifically says they must, or if there’s no power-of-sale clause in the mortgage. These court foreclosures take longer and give the borrower an opportunity to defend themselves in the foreclosure suit.

Notice and Sale Process

Notice of Sale

The advertisement or notice for the sale must include the following information:

- Names of the plaintiff and defendant, or other parties involved.

- A legal description of the land, referencing the deed book and page number where the full legal description of the property is detailed.

- A common description of the land, listing the street address and map and parcel number. If there’s no street address, use a subdivision, lot, or tract number.

- The time and place of the sale.

The trustee or other party conducting the sale must send a copy of the required notice to the debtor and any co-debtor. This notice must be sent by registered or certified mail, return receipt requested. The notice should be addressed to the debtor at:

- The property’s mailing address, if available;

- The debtor’s last known mailing address or another mailing address designated by the debtor for receiving notices.

The lender must ensure that the notice of sale is published in a local newspaper at least 20 days before the sale. If no newspaper is published in the county where the land is to be sold, there is no need to advertise in a newspaper unless a court requires it.

If the advertisement cannot be made in a newspaper, the officer must post written notices of the sale for 30 days in at least five of the most public places in the county. These places must be the courthouse door, near the defendant’s neighborhood, and somewhere in the civil district where the land is located.

Sale

Whether the auction is physical or online, it must start and end between 9 am and 7 pm on the scheduled day. The day can be any day from Monday to Saturday, provided it is not a state or federal legal holiday.

Before 10:00 a.m. on the day of the sale, the defendant or any other person whose property is to be sold can provide the officer or person conducting the sale with a division plan of the lands to be sold. This plan, signed and dated after the advertisement date by the defendant or other person, will allow only the portion of the land needed to cover the debt and costs to be sold according to the provided plan. If no such plan is provided, the land may be sold as a whole without division.

Avoiding Foreclosure by Selling Your Mortgage Note

In Tennessee, if you’re facing foreclosure, you can sell your mortgage note to a trusted buyer. This means you sell the rights to your mortgage payments in return for a one-time cash payment. Then, you can use the cash to pay your original lender, thus discharging the original mortgage and avoiding foreclosure.

Borrower Rights and Protections

If a borrower in Tennessee doesn’t waive their right of redemption after a non-judicial foreclosure sale, they may redeem the property within two years by paying the total debt plus costs.

Redemption and Deficiency Judgments

Redemption

The right of redemption is limited. Borrowers have only two years to redeem their property after the foreclosure sale.

Deficiency Judgments

In a lawsuit brought by a creditor to collect the remaining balance due after the trustee’s or foreclosure sale of property secured by a deed of trust or mortgage, the creditor is entitled to a deficiency judgment that covers the full amount of the debt.

In such cases, unless there is evidence of fraud, collusion, misconduct, or irregularities in the sale process, the deficiency judgment will equal the total debt before the sale plus the costs of foreclosure and sale, minus the fair market value of the property at the time of sale. The law assumes that the sale price of the property equals its fair market value at the time of the sale unless proven otherwise.

To rebut this presumption, the debtor must show by a preponderance of the evidence that the sale price was significantly lower than the property’s fair market value at the time of the foreclosure. If the debtor successfully proves this, the deficiency will be calculated as the total debt amount before the sale plus the costs of foreclosure and sale, minus the fair market value as determined by the court.

Special Protections and Programs

In Tennessee, there aren’t any special state-run programs to help homeowners facing foreclosure, just the standard process that doesn’t involve the courts. So, if you’re facing foreclosure in Tennessee, you’ll need to find help elsewhere.

Comparative Insights

In this section, we’ll study how Tennessee’s foreclosure process aligns with or differs from national norms.

Publish Sale Notice

In Tennessee, there’s a requirement to publish a sale notice 20 to 25 days before the auction. This duration is shorter compared to many other states, such as Massachusetts, Washington, and West Virginia.

Costs in a Range and Comparison to Other States

Foreclosure costs in Tennessee range between $1,500 and $4,000. This cost efficiency is common to non-judicial foreclosure states. For example, in Georgia, Idaho, Michigan, and Rhode Island, where foreclosures are typically non-judicial, foreclosure costs $1,500 to $4,000.

Impact on Credit Score

The impact of foreclosure on a credit score in Tennessee is consistent with the effects observed nationwide. A foreclosure typically results in a significant decrease in the homeowner’s credit score, often by 100 points or more. This reduction is on the credit report for seven years but becomes less impactful over time with responsible credit management.

Conclusion

To undergo foreclosure in Tennessee without getting burned, you need to understand its non-judicial process and the rights and protections afforded to borrowers. Selling a mortgage note can be a viable alternative to avoid foreclosure.