North Dakota Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

If you’re a homeowner in North Dakota, you may find foreclosure stressful if you aren’t aware of North Dakota’s foreclosure laws and processes. Fortunately, this article gives a detailed look at how foreclosure works in North Dakota. We’ll cover the important laws, the steps involved, and what rights you have as a homeowner. Let’s go.

Foreclosure Process Overview

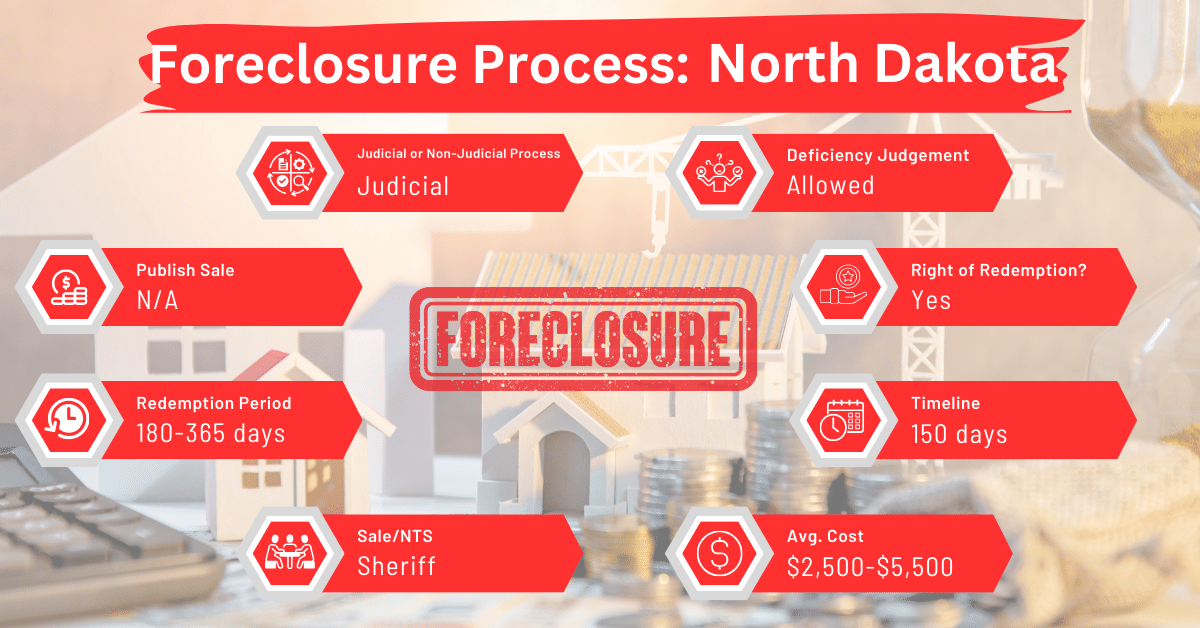

In North Dakota, the foreclosure process is strictly judicial. It spans around 150 days. This timeframe is considerably shorter than in many other states, where the process can often stretch beyond a year.

Pre-foreclosure Period

At least thirty days but no more than ninety days before starting any legal action or proceeding to foreclose a mortgage on real estate, the lender must serve a written notice on the record title owner of the real estate.

The notice must contain:

- A description of the real estate.

- The date the mortgage was signed and the amount of the mortgage.

- The amount needed to update any overdue installments of principal and interest as of a specified date, and the costs the mortgagee has paid for taxes, insurance, and maintenance, with each expense itemized separately.

- A statement indicating that if the due amount is not paid within thirty days from when the notice is mailed or served, foreclosure proceedings will begin.

The lender can serve the foreclosure notice by mail, following rule 4 of the North Dakota Rules of Civil Procedure. They should address the notice to the record owner at the post office address listed in the mortgage or the county recorder’s chain of title records. If the post office address is not available in these records, they should address the notice to the record owner at the nearest post office to any part of the real estate.

Exceptions to Serving the Notice

If the record title to the real estate is in the name of someone who has died, and no personal representative has been appointed in the county where the real estate is located, the lender doesn’t need to serve the notice. A certificate from the judge or district court clerk stating that no personal representative has been appointed is sufficient proof.

Besides that, the lender doesn’t need to personally serve the notice if the property is abandoned. They also don’t need to serve it if they’ve tried to serve it by mail three times and it was returned as refused or unclaimed.

Types of Foreclosures

Since North Dakota only practices judicial foreclosures, all foreclosure cases go through the court system. In other words, the lender must file a lawsuit in district court to foreclose on a mortgage for real property. The complaint must clearly state the details of the mortgage being foreclosed, define the applicable redemption period, and specify whether a deficiency judgment will be sought and against which parties.

Then, the court will issue a judgment for the due amount and the legal costs, and will order the sale of the property to pay this amount. The court may also allow the purchaser to take possession of the property after the redemption period ends, unless the court decides differently. The judgment will state that during the redemption period, the debtor or property owner retains the right to possess, rent out, use, and benefit from the sold property.

Notice and Sale Process

The foreclosure sale in North Dakota is advertised for about two months. The notice of sale is provided to the borrower and published in the county newspaper.

The county sheriff, their deputy, or a person the court appoints must conduct a foreclosure sale of mortgaged property in the county where the property or part of it is located. They must carry out the sale following the legal procedures and notice requirements for selling real property through execution.

At the sheriff’s sale, the person conducting the sale must give the buyer a certificate of sale. If the property is not redeemed during the allowed redemption period, the person who conducted the sale, or their successor, must give a deed to the buyer, the buyer’s heirs, or assigns, or anyone else who has acquired the buyer’s title, whether through redemption or other means.

This deed transfers all the rights, title, and interest that the original property owner (the mortgagor) had at the time of the mortgage or acquired later. The deed also prevents any further claims, rights, or redemption on the property by any party involved in the foreclosure, their heirs, personal representatives, and anyone claiming through them after the foreclosure process began.

Avoiding Foreclosure by Selling Your Mortgage Note

One alternative to foreclosure in North Dakota is selling your mortgage note to a reputable note buyer. This option can provide immediate financial relief and prevent the negative consequences of a foreclosure.

Borrower Rights and Protections

Borrowers in North Dakota have specific rights during the foreclosure process, including the right to be notified of the foreclosure and the right to a fair judicial process. If a debtor wishes to reinstate their mortgage, they must pay the delinquent amount within the 30-day pre-foreclosure period.

Redemption and Deficiency Judgments

North Dakota law provides for a redemption period of 180 to 365 days. During this timeframe, the borrower can reclaim the foreclosed property by paying the full sale price plus additional costs.

In a foreclosure of residential property with four or fewer units on up to forty contiguous acres that include an owner-occupied residence, the plaintiff (lender) cannot seek a deficiency judgment. However, for agricultural land exceeding forty acres, they can seek a deficiency judgment for the difference between the debt amount and the fair market value of the land at the time the legal action starts.

In all other cases, the plaintiff can seek a deficiency judgment for the difference between the property’s appraised value and the amount due. The cost of this appraisal is usually included in the money awarded to the lender.

Special Protections and Programs

North Dakota offers various protections and programs to assist homeowners facing foreclosure. These include legal aid services and counseling, as well as government initiatives like loan modification programs.

Comparative Insights

When comparing North Dakota’s foreclosure processes with those in other states, we observe notable differences in notice periods, costs, and credit score impacts.

Publish Sale Notice

The notice of sale in North Dakota must be published for about two months, which is similar to the duration required in Alaska, Delaware, and Hawaii.

Costs in a Range and Comparison to Other States

Foreclosure costs in North Dakota typically range from $2,500 to $5,500. These costs are closest to the costs in Kansas and Maine, where judicial foreclosures could set you back by $2,500 to $5,000.

Impact on Credit Score

Foreclosure in North Dakota, like in other states, can significantly impact a borrower’s credit score, usually leading to a decrease of 100 points or more.

Conclusion

To navigate the foreclosure laws and processes in North Dakota, you need to understand the state’s judicial system and the rights and protections available to borrowers. For those facing foreclosure, selling the mortgage note can be a viable option to avoid the process and its repercussions.