New Mexico Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

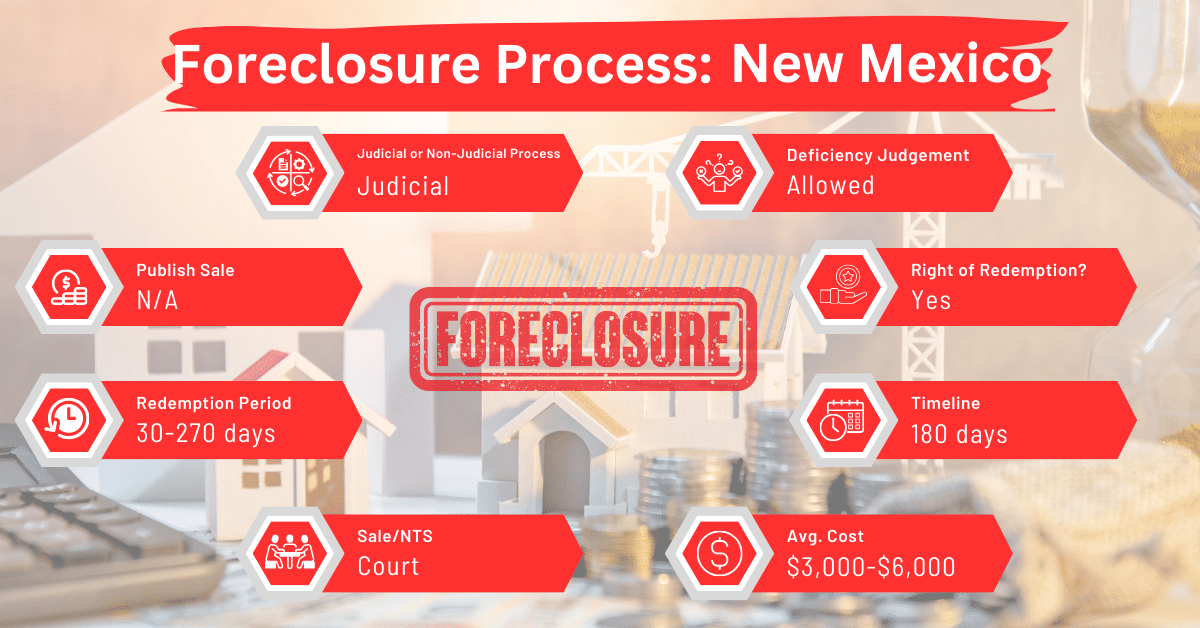

In New Mexico, the foreclosure process is primarily judicial. This means that the lender must go through the court system to get a foreclosure judgment. Below, you’ll discover everything you need to know about New Mexico’s foreclosure laws and processes.

Foreclosure Process Overview

New Mexico requires all foreclosures to be handled through the court system. Typically, foreclosure spans about six months. It starts with the lender filing a foreclosure complaint in court against the borrower and ends with a deficiency judgment or redemption where applicable.

Pre-foreclosure Period

The state of New Mexico doesn’t require the lender to notify the debtor before initiating the pre-foreclosure process, but the mortgage or deed of trust may sometimes require this. Once the complaint is filed, the borrower is given notice which he must respond to within 30 days.

In New Mexico, no real property can be sold in a judicial foreclosure until 30 days after the foreclosure judgment or decree has been entered. During this 30-day period, the current owner of the property, along with his heirs, personal representatives, assigns, or any junior lienholder, has the opportunity to prevent the sale.

This can be done by paying off the judgment or decree. They must deposit the required payment, including any accrued interest and legal costs, with the office of the clerk of the district court where the judgment, decree, or order was made.

Types of Foreclosures

New Mexico laws dictate judicial foreclosure for nearly all residential properties. Some commercial and business properties are eligible for non-judicial foreclosure. In 2008, the state adjusted regulations around the use of deeds of trust, which are used to facilitate non-judicial foreclosures. All that said, New Mexico remains largely a judicial foreclosure state.

Notice and Sale Process

New Jersey law provides that real estate mortgages involved in a foreclosure must be sold at a public auction between the hours of 9 am and sunset on the same day. The time, place, and a full description of the property to be sold must be publicly announced in the following ways at least four weeks prior to the sale:

- The announcement must be published in either English or Spanish, whichever is likely to reach the widest audience in the county where the property is located.

- If no newspaper is published in the said county, the announcement should appear in the newspaper designated as the official paper for that county.

- The notice must be posted in six of the most public places within the county, and these notices can be printed, written, or a combination of both.

All notices of sale by sheriffs under an execution, order, or decree from any district court in this state must include the following information:

- Case Information: The style or title of the case in which the judgment, order, or decree was issued.

- Nature of the Action: A brief description of the nature of the legal action.

- Judgment or Decree Details: The date the judgment was rendered or the order/decree was issued.

- Amount Due: The total amount due, including interest accrued up to the date of the sale.

- Property Description: A detailed description of the property being sold, sufficient for its complete identification.

- Sale Details: The date, time, and terms of the sale.

Avoiding Foreclosure by Selling Your Mortgage Note

If you’re tackling foreclosure in New Mexico, try looking into selling your mortgage note. This option can circumvent the foreclosure process and mitigate its effects on your credit score and property.

Borrower Rights and Protections

Borrowers in New Mexico can redeem their property up to nine months after a foreclosure sale, though loan terms may reduce this period to one month. Lenders may evict former residents more easily than other buyers, especially if the lender is the highest bidder in a foreclosure sale.

Redemption and Deficiency Judgments

Redemption

Former property owners in New Mexico have the right to redeem the property within nine months of the foreclosure sale. To do that, they’ll pay the full sum owed on the delinquent loan, taxes, and interest. However, some mortgage lenders shorten this window to 30 days.

Deficiency Judgments

Within six years after a trustee’s sale of real estate under a deed of trust, anyone owed money can start a separate lawsuit to go after the remaining balance. This lawsuit is to secure a deficiency judgment, which would cover the difference between what was originally owed and the amount the property sold for at the trustee’s sale.

The amount of the deficiency judgment is calculated by adding up everything still owed to the beneficiary (or their representatives, successors, or assigns) as of the sale date. This total may include balances from prior mortgages, deeds of trust, liens, and real estate contracts, with accrued interest, minus the trustee’s sale price.

The court decides the final sum. Any judgment awarded will also tack on interest from the sale date at the rate specified in the deed of trust or contract, as well as any legal costs incurred.

However, if the deed of trust was securing a residential loan for a low-income household, the lender can’t pursue a deficiency judgment. Furthermore, if there’s any remaining balance after the trustee’s sale or a judicial foreclosure, it cannot be reported to credit agencies. It can’t even be shared with anyone other than the original borrower or their personal representatives unless the law requires disclosure.

Special Protections and Programs

New Mexico offers various programs and initiatives to assist homeowners facing foreclosure. These include loan modification options, government assistance programs, and a compulsory foreclosure mediation program.

Comparative Insights

Comparing New Mexico’s foreclosure laws to those of other states shows differences in how long notices take, the costs involved, and impacts on credit scores.

Publish Sale Notice

New Mexico’s foreclosure process includes a notice period of approximately four weeks before the sale. This duration is short compared to other judicial foreclosure states, like Delaware, Indiana, Kansas, Maine, and Maryland.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in New Mexico fall anywhere between $3,000 and $6,000. Compared to other states, these costs are fair.

Impact on Credit Score

Experiencing foreclosure in New Mexico can significantly reduce a homeowner’s credit score by 100 points or more. This negative effect is consistent across the United States.

Conclusion

New Mexico’s foreclosure processes are usually judicial. For homeowners facing foreclosure, selling the mortgage note can assist with escaping foreclosure.