New Jersey Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Foreclosure in New Jersey is a legal process where a lender tries to get back the money left on a loan from a borrower who has stopped paying. This process requires selling the property that was used as security for the loan. New Jersey’s foreclosure laws are detailed and clear. This article will explain the important parts of these foreclosure laws and how they work in New Jersey.

Foreclosure Process Overview

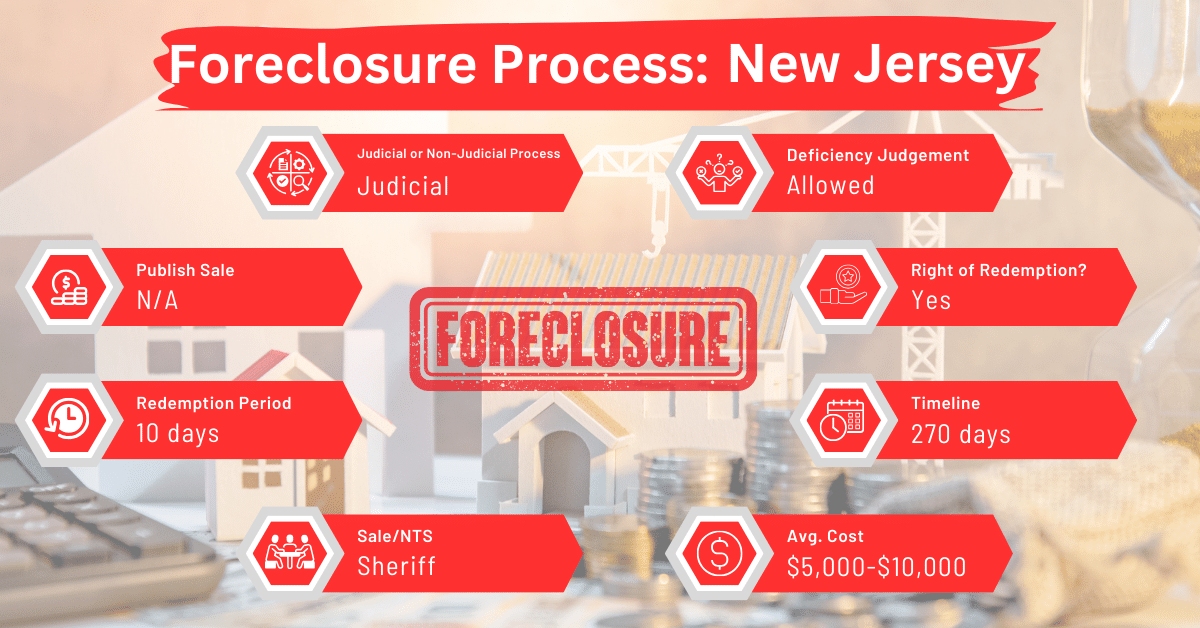

New Jersey exclusively uses judicial foreclosures, involving the court system. The typical foreclosure process in New Jersey can last about 270 days, which is relatively longer compared to other states. This process begins when the lender files a lawsuit against the defaulting borrower, and if the court rules in favor of the lender, the property is ordered to be sold at auction.

Pre-foreclosure Period

Before a residential mortgage lender can accelerate the maturity of a mortgage due to non-payment and initiate foreclosure or other legal actions to take possession of the property, they must provide a notice of intention to the residential mortgage debtor.

This notice must include the right to cure the default and be sent at least 30 days, but no more than 180 days, before such actions commence.

The notice must be:

- Written and sent to the Department of Community Affairs.

- Mailed to the debtor by registered or certified mail, return receipt requested, at the debtor’s last known address. If the debtor’s address is different from that of the mortgaged property, the notice should be mailed to the address of the mortgaged property.

- Deemed effective on the date it is delivered in person or mailed.

The written notice should clearly and conspicuously state:

- The specific obligation or real estate security interest.

- The nature of the claimed default.

- The debtor’s right to cure the default.

- The actions needed to cure the default, including the amount of money, if any, and interest required.

- The deadline for the debtor to cure the default to prevent foreclosure, which must be no less than 30 days after the notice becomes effective, including the contact details for payment or tender.

- Notice that if the default is not cured by the specified date, the lender may initiate foreclosure proceedings.

- The debtor’s right, if applicable, to transfer the real estate to another individual who may then have the right to cure the default.

- Recommendation to seek legal counsel, including contact information for the New Jersey Bar Association or local Lawyer Referral Service and, for those who cannot afford legal representation, the local Legal Services Office.

- Information about potential financial assistance from state, federal, or nonprofit programs, as identified by the Commissioner of Banking and Insurance.

- The lender’s name, address, and a contact number for a lender representative whom the debtor may contact to dispute the default or the calculated amount required to cure it.

- The debtor’s option to enter the Foreclosure Mediation Program after a mortgage foreclosure complaint is filed.

- Entitlement to no-cost housing counseling through the Foreclosure Mediation Program, including contact details.

- If the mortgaged property has between one and four dwelling units, and one is occupied by the debtor or a family member at the time the loan originated, and the property is eligible for receivership due to maintenance issues, the lender must file for a receivership order

- The licensing status of the lender under the New Jersey Residential Mortgage Lending Act, specifying whether the lender is licensed or exempt.

The notice is not required if the debtor has voluntarily surrendered the property. If more than 180 days have passed since the notice was sent and no legal action has commenced, the lender must send a new notice at least 30 days but no more than 180 days before taking action. If the property eligible for foreclosure has one to four dwelling units, and one is occupied by the debtor or their family and meets the conditions for receivership, the lender must seek a court order to appoint a receiver.

Regardless of whether the required notice of intention to foreclose is actually given, the debtor has the right to cure the default and reinstate the residential mortgage. This right can be exercised at any time up to the entry of the final judgment or until the court or office issues an order of redemption.

To effectively cure a default, a debtor must:

- Pay or tender the full amount that would have been due without the default, in the form of cash, a cashier’s check, or a certified check to the person designated.

- Fulfill any other obligations that would have been required if the default had not occurred, including those accelerated by the mortgage.

- Cover any court costs and attorney’s fees, up to the maximum allowed under the Rules Governing the Courts of the State of New Jersey.

- Pay all contractual late fees as stipulated in the note or security agreement.

Curing a default restores the debtor to their original position as if the default had never happened, effectively nullifying any accelerated obligations due to the default from the date of the cure.

If a default is cured before a foreclosure action is filed, the lender cannot initiate foreclosure based on that default. If the default is cured after a foreclosure action has started, the lender must notify the court in writing of the cure. Upon receiving this notice, the court should dismiss the foreclosure action without prejudice.

Types of Foreclosures

New Jersey’s foreclosure process is strictly judicial, meaning all foreclosures go through the court system. This approach provides borrowers with a significant period to contest the foreclosure or find solutions to stop the process.

Notice and Sale Process

Before a lender can proceed with final judgment in a foreclosure case, they must first provide the debtor with a notice. This notice must be mailed at least 14 days before the lender submits the proofs necessary for entry of a foreclosure judgment. It must include the name and address of the lender, a contact telephone number for a representative of the lender, and information on how the debtor can obtain the amount required to cure the default.

The notice of sale must be posted on the property and in the county office where the property is located. notice must also inform the debtor that if they do not respond, the lender will proceed with submitting the proofs for a final judgment in the foreclosure action, at which point the debtor will lose the right to cure the default. The lender is required to attach a copy of this 14-day notice to their application for final judgment.

Within 10 days of receiving this notice, the debtor has the option to respond by mailing a statement to the lender. This statement must certify, in good faith, that the debtor has a reasonable likelihood of paying the necessary amount to cure the default within 45 days from when the notice became effective. This statement must be sent via registered or certified mail, return receipt requested, to the address of the lender provided in the notice.

If a lender receives such a statement from the debtor, they are not permitted to submit the proofs necessary for final judgment in the foreclosure process any sooner than 46 days after the notice initially became effective. This ensures the debtor has sufficient time to arrange payment to cure the default.

Sale

In New Jersey, the following procedures apply to the sale of mortgaged premises under foreclosure action:

Bid Submission

Bids may be submitted in the name of the assignee of the foreclosing plaintiff.

Sale Timing and Special Master Appointment

The sheriff must conduct a sale within 150 days of receiving a writ of execution from the court related to any foreclosure proceeding.

If the sheriff is unable to meet the 150-day requirement, the foreclosing plaintiff may request the appointment of a Special Master to conduct the sale. Upon such a request, the office will issue an order appointing a Special Master to oversee the foreclosure sale. This order may cover one or more properties within the same vicinage.

Payment Requirements at Sale

The successful bidder must pay a 20% deposit either in cash or by certified or cashier’s check, payable to the sheriff of the county where the sale occurs, immediately at the end of the sale.

If the successful bidder fails to meet this requirement, they will be considered in default. The sheriff will void the original sale and immediately conduct a resale of the premises without needing to adjourn, renotify parties, or republish sale notices.

If a resale occurs due to a bidder’s default, the defaulting bidder will be responsible for any additional costs incurred, including any shortfall between their original bid and the amount recouped at the resale. If the plaintiff is the successful bidder at the resale, they must credit the fair market value of the property against the amount owed.

Remote Bidding

With the sheriff’s consent, physical presence of the attorney or representative of the party initiating the foreclosure is not required at the sale. Instead, a letter with bidding instructions may be sent to the sheriff in lieu of appearing in person.

At the conclusion of the sheriff’s sale, the plaintiff’s attorney is required to prepare and deliver to the sheriff a deed for execution. This deed must be delivered to the sheriff within 10 days following the sale date. Despite the deed being prepared by the plaintiff’s attorney, the sheriff is entitled to the standard authorized fee for reviewing the deed.

Within two weeks after the sale, the sheriff’s office must deliver the fully executed deed to the successful bidder, contingent upon the bidder paying the remaining balance due. This payment must be made to the sheriff in either cash, certified check, or cashier’s check.

If the payment is received after the deadline and additional interest has accrued, the sheriff is responsible for forwarding the total collected amount to the plaintiff. This total will be less any fees, costs, and commissions that are owed to the sheriff, plus any additional interest collected from the successful bidder.

Avoiding Foreclosure by Selling Your Mortgage Note

For homeowners in New Jersey facing foreclosure, selling their mortgage notes to a reputable buyer can be an effective alternative. This option eliminates the need for foreclosure.

Borrower Rights and Protections

New Jersey law ensures that borrowers are adequately informed about the foreclosure process through detailed notices and court proceedings. The state also offers a foreclosure mediation program, providing borrowers with an opportunity to negotiate with lenders under court supervision.

Redemption and Deficiency Judgments

In New Jersey, borrowers have a 10-day redemption period after the foreclosure sale. This means that once the property is sold, the borrower can reclaim it by paying the full amount of the debt. Deficiency judgments, where borrowers owe the remaining mortgage balance after the sale, are allowed under certain conditions.

Special Protections and Programs

New Jersey offers various programs and initiatives to assist homeowners facing foreclosure. These include a mandatory mediation program. A court may order mediation when a homeowner-borrower responds to a foreclosure complaint.

Alternatively, the homeowner-borrower may initiate mediation according to court rules. The courts must allow the homeowner-borrower at least 60 days from the receipt of the foreclosure complaint and summons to start the mediation process.

The homeowner-borrower is eligible to participate in mediation only if they submit a certification document to the court. This document must be signed by a trained foreclosure prevention and default mitigation counselor, confirming that the homeowner-borrower is actively cooperating with the counselor.

As a way of protecting borrowers, New Jersey law stipulates that they can participate in the mediation program for free.

Comparative Insights

Comparing New Jersey’s foreclosure laws with other states’ laws underscores notable variations in notice timelines, associated costs, and effects on credit scores.

Publish Sale Notice

New Jersey’s foreclosure process requires a notice period of approximately 10 days before the sale. This duration is short, considering that New Jersey is a judicial foreclosure state. Other states where foreclosure is exclusively judicial, including Delaware, Indiana, Kansas, Maine, and Maryland, require much longer notice periods.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in New Jersey are between $5,000 and $10,000. Compared to other states, these costs are on the higher end. For instance, in North Dakota, judicial foreclosure costs just $2,500 to $5,500. Meanwhile, foreclosure costs in South Dakota range from $2,000 to $6,000.

Impact on Credit Score

Like in other states, foreclosure in New Jersey can significantly impact a homeowner’s credit score, often leading to a decrease of 100 points or more.

Conclusion

New Jersey’s foreclosure laws and processes are judicial-only, necessitating court oversight. For homeowners facing foreclosure, selling the mortgage note is an easy and more profitable way to avoid foreclosure.