Exploring Michigan’s Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Among the states in the US, Michigan stands out for its distinct approach to foreclosure. In this blog post, you’ll find the specifics of Michigan’s foreclosure procedures.

Foreclosure Process Overview

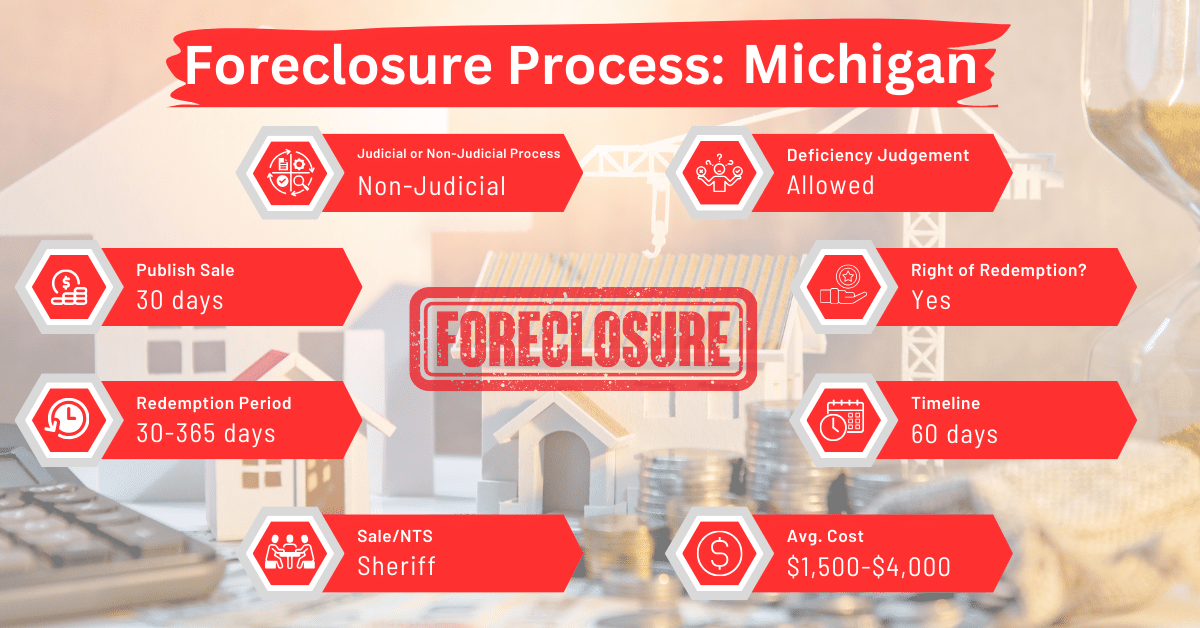

Michigan primarily handles foreclosures out of court, with the process typically taking about 60 days. This duration is influenced by the length of the redemption period, which can range from 30 days to a year.

Pre-foreclosure Period

Although Michigan law does not mandate lenders to send a default notice before scheduling a foreclosure sale, the mortgage agreement might require it. This period is crucial for borrowers to address the default and potentially halt the foreclosure process.

If the borrower can pay all the overdue amounts, including principal, interest, and legal fees, to the court before the court decides to sell the property, then the lawsuit will be dismissed. This means the legal action to foreclose or settle the mortgage is stopped because the overdue payments have been fully paid.

Types of Foreclosures

Judicial Foreclosure

When a lender or mortgagee in Michigan files an action to foreclose on a property due to unpaid mortgage or land contract, the court has the authority to order the property to be sold. The sale should cover the amount owed under the mortgage or land contract, plus any associated legal costs. However, these specific time restrictions are in place to protect borrowers:

- For properties under a mortgage, the judge cannot order a sale until at least six months after the foreclosure complaint has been filed.

- For properties involved in a land contract, the judge cannot order a sale until at least three months after the foreclosure complaint has been filed.

When a property is foreclosed judicially, the sale must be conducted by the county clerk where the court decision was made, or where the property is located. It could also be handled by a deputy county clerk, or someone else who is officially authorized by the court to conduct the sale.

These sales are public and must occur between 9 a.m. and 4 p.m. Typically, the sale takes place at the courthouse or the usual location of the circuit court in the county where the property is located, unless the court specifies a different location.

Non-judicial Foreclosure

Non-judicial foreclosures are prevalent in Michigan. This is because many mortgage agreements in this state contain power of sale clauses that allow lenders to sell properties out of court if borrowers default. This method is faster and less cumbersome than court foreclosures.

Notice and Sale Process

Notice

To inform the public that a property is being foreclosed and will be sold, the notice of the foreclosure sale must be published once a week for four consecutive weeks. This should be done in a newspaper that circulates in the county where the property to be sold is located.

If there is no newspaper in that county, the notice should be published in a newspaper from a neighboring county. Fifteen days after the notice is first published, a true copy of the notice must be prominently displayed on the property being sold.

A notice of foreclosure by advertisement needs to include the following details:

- Names Involved: The names of the person or entity that took out the mortgage (mortgagor), the original lender (mortgagee), and any entity that is now holding the mortgage and carrying out the foreclosure (foreclosing assignee), if applicable.

- Mortgage Details: The date the mortgage was signed and the date it was officially recorded.

- Amount Due: The total amount owed on the mortgage as of the date the notice is issued.

- Property Description: A detailed description of the property as it is listed in the mortgage documents.

- Street Address: The street address of the property, if available. Note that the notice and any resulting sale are still valid even if the street address listed is incorrect or missing.

- Redemption Period: For mortgages signed after December 31, 1964, the notice must state the duration of the redemption period, which is the time frame the mortgagor has to reclaim the property by paying off the debt.

- Liability for Damage: A warning that if the property is sold at foreclosure, the original borrower could be held responsible for any damage to the property that occurs during the redemption period.

- Contact Information for Attorney: The name, address, and phone number of the attorney representing the party that is foreclosing the mortgage.

Sale

The sale is open to the public and held between 9 am. and 4 pm. It takes place at the location where the county’s circuit court is held, within the county where the property, or at least part of it, is located. The sheriff, undersheriff, or deputy sheriff, the county, or the person specified in the mortgage conducts the sale. The property goes to the highest bidder.

Avoiding Foreclosure by Selling Your Mortgage Note

Selling mortgage notes to a reputable buyer is an alternative route that can effectively prevent the foreclosure process and its associated impacts. Those impacts are usually negative, such as credit score damage and the loss of one’s home.

By choosing to sell their mortgage note, homeowners can gain immediate financial relief. This approach is a solid lifeline to those in financial distress. It also allows for a more controlled and dignified exit from foreclosure.

Borrower Rights and Protections

Michigan’s foreclosure laws require lenders to inform borrowers about the foreclosure sale. Besides this, Michigan’s Judicature Act provides an avenue of defense for borrowers in non-judicial foreclosures.

After a property is foreclosed non-judicially and sold through a public advertisement after February 11, 1933, and the lender ends up buying the property themselves or indirectly takes ownership, they may later try to obtain a deficiency judgment. In other words, the lender may try to recover the difference between the sale amount of a foreclosed property and its actual worth.

In such cases, the borrower can defend themselves by arguing that the property was actually worth the total debt at the time it was sold, or that the sale price was much less than the property’s true value. If the borrower can prove this, it may completely or partially block the lender from getting a deficiency judgment, depending on how much the property was actually worth compared to the sale price.

This rule doesn’t impact the rights of other buyers or third parties who weren’t involved in the issue and doesn’t change the negotiability of any financial documents like notes or bonds secured by the mortgage. The outcome of this defense also doesn’t affect the ownership of the property. A buyer who purchased at the foreclosure sale keeps the property regardless of the outcome.

Also keep in mind that this defense can’t be applied to foreclosure sales that were conducted under a court order, nor to any legal judgments made in foreclosure lawsuits, nor to any sales confirmed by a court. In other words, the defense doesn’t apply to judicial foreclosures in Michigan.

Redemption and Deficiency Judgments

After a foreclosure sale in Michigan, the borrower has a redemption period of about six months. Within this period, they can reclaim their property by paying the winning bid amount and applicable costs.

If a property described in a deed is not redeemed within the designated redemption period, the deed becomes effective. This means that the person named in the deed (the grantee), and their heirs or assigns, will gain all the rights, title, and interest in the property that the original owner (mortgagor) had when the mortgage was signed, or any time after that.

Once the deed becomes effective, it is considered a valid record and doesn’t need to be recorded again. However, the sale does not affect the rights of any person who has a valid lien (a legal claim on the property as security for a debt) that existed before the mortgage lien. These rights remain unaffected by the sale of the property.

However, deficiency judgments in Michigan are limited to the scenarios discussed above.

Special Protections and Programs

Michigan offers various programs and initiatives to assist homeowners facing foreclosure. These include loan modification options and foreclosure avoidance negotiations, aimed at providing financial relief and alternative solutions.

Comparative Insights

While Michigan’s foreclosure laws and processes have their unique characteristics, they also share similarities with other states in some respects. Let’s examine some of these similarities.

Publish Sale Notice

Michigan mandates a 30-day notice period before conducting a foreclosure sale. This period is relatively shorter compared to many other states like Alaska, Colorado, Delaware, Hawaii, Montana, and Nevada, where the mandated notice periods are between 50 and 90 days.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Michigan typically range from $1,500 to $4,000. This cost bracket is moderate when compared to other states in the US, such as Connecticut, Delaware, Florida, Illinois, Kentucky, Louisiana, Maryland, Nebraska, New Jersey, New Mexico, New York, Ohio, Pennsylvania, South Carolina, and Vermont. In these states, foreclosure could cost up to $10,000.

Impact on Credit Score

A foreclosure can lead to a decrease of 100 points or more in a borrower’s credit score. This decrease remains on the credit report for 7 years. However, its effect decreases over time if the borrower manages their credit responsibly.

Conclusion

Based on this examination of Michigan’s foreclosure laws and processes, it’s clear that non-judicial foreclosures are predominant in the state. Homeowners facing foreclosure in Michigan may sell their mortgage notes to avoid the entire process and its consequences.