Maryland Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

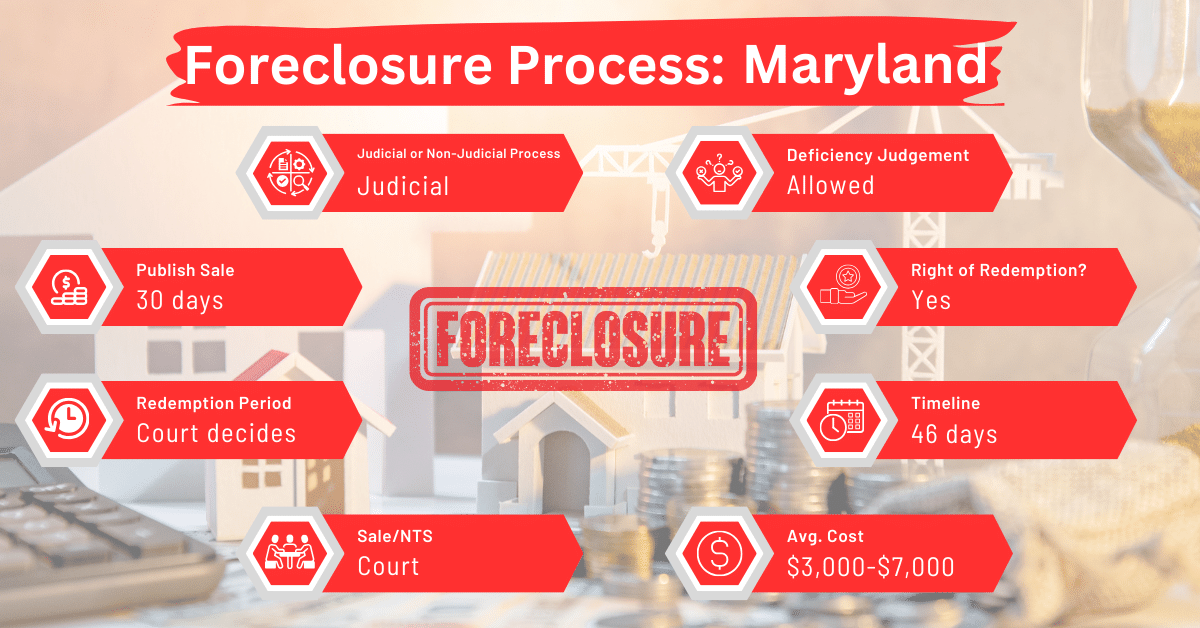

Foreclosure in Maryland is conducted exclusively through the courts. The typical foreclosure process in Maryland is relatively fast for a judicial process, lasting about 46 days. This expedited timeline is partly due to the state’s fast-track process for vacant properties.

Pre-foreclosure Period

The pre-foreclosure process in Maryland begins with the lender filing a complaint against the borrower and obtaining a decree of sale from a court. The court then determines whether a default has occurred and, if so, fixes the amount of debt, interest, and costs due. The borrower is given a reasonable time to make payment before the property is ordered to be sold.

Types of Foreclosures

Maryland employs judicial foreclosures. In other words, a lender who wants to foreclose on his property for any reason must file an action for foreclosure at the court with the requisite jurisdiction. This process starts when the lender files a lawsuit against the borrower who has defaulted on their mortgage. The court oversees the entire process, including the sale of the property.

Notice and Sale Process

A notice of sale must be published in a local newspaper for three consecutive weeks. The trustee must also send a notice of sale to the borrower and any other lien holders at least 10 days before the sale date. The sale is spearheaded by a licensed auctioneer, often outside the courthouse. After the sale, a notice is published in a local newspaper. If no one objects to the sale within 30 days, the court confirms the sale.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Maryland facing foreclosure have the option to sell their mortgage notes to a reputable note buyer. This can provide an alternative solution, potentially avoiding the foreclosure process and its negative consequences.

Borrower Rights and Protections

Borrowers in Maryland have the right to be properly served with foreclosure documents and to respond to the foreclosure action. Maryland law does not establish a specific redemption period for borrowers, but the courts can set one on a case-by-case basis.

Redemption and Deficiency Judgments

There is no established redemption period in Maryland, but the courts may set one. With respect to deficiency judgments, filing for a deficiency judgment is the only way a lender can pursue further compensation for any shortfall after the sale of residential property that the owner lived in. This means they can ask the court to order the borrower to pay the remaining balance. This request must be made within three years after the court has approved the final report on the sale.

Comparative Insights

Maryland’s judicial-only approach offers a distinctive perspective. Understanding how Maryland’s foreclosure practices compare with other states is essential for homeowners, investors, and legal professionals.

Publish Sale Notice

Maryland mandates that the notice of sale be published for three weeks in a local newspaper. This requirement is consistent with some judicial foreclosure states like Indiana, Illinois, Kentucky, and Kansas.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Maryland, which include legal fees and court costs, are generally between $3,000 and $7,000. The range is the same across some states that favor judicial foreclosures as well. These states are: Connecticut, Illinois, Maryland, Nebraska, Ohio, and Vermont. Judicial foreclosures tend to be more expensive than non-judicial ones due to the involvement of the court system. In states where non-judicial foreclosures are prevalent, the costs might be lower as these processes are typically quicker and involve fewer legal formalities.

Impact on Credit Score

The impact of foreclosure on a borrower’s credit score in Maryland is similar to that in other states. Foreclosure typically leads to a significant decrease in credit scores, often by 100 points or more. This impact is a consistent feature across the United States, regardless of the state-specific foreclosure processes.

Conclusion

In Maryland, the foreclosure process goes through the courts, which gives homeowners certain protections but also means you really need to know your way around the legal details. If you’re looking to avoid the downsides of foreclosure, selling your mortgage note could be a smart move. This approach can help you steer clear of the financial and emotional strain that often comes with foreclosure.