Understanding Illinois Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Illinois’s real estate market and legal frameworks present unique challenges and opportunities. This article provides a detailed overview of foreclosure laws and processes in Illinois. As you read it, you’ll uncover insights and guidance relevant to you, regardless of whether you’re a homeowner, investor, and anyone involved in the real estate market.

Foreclosure Process Overview in Illinois

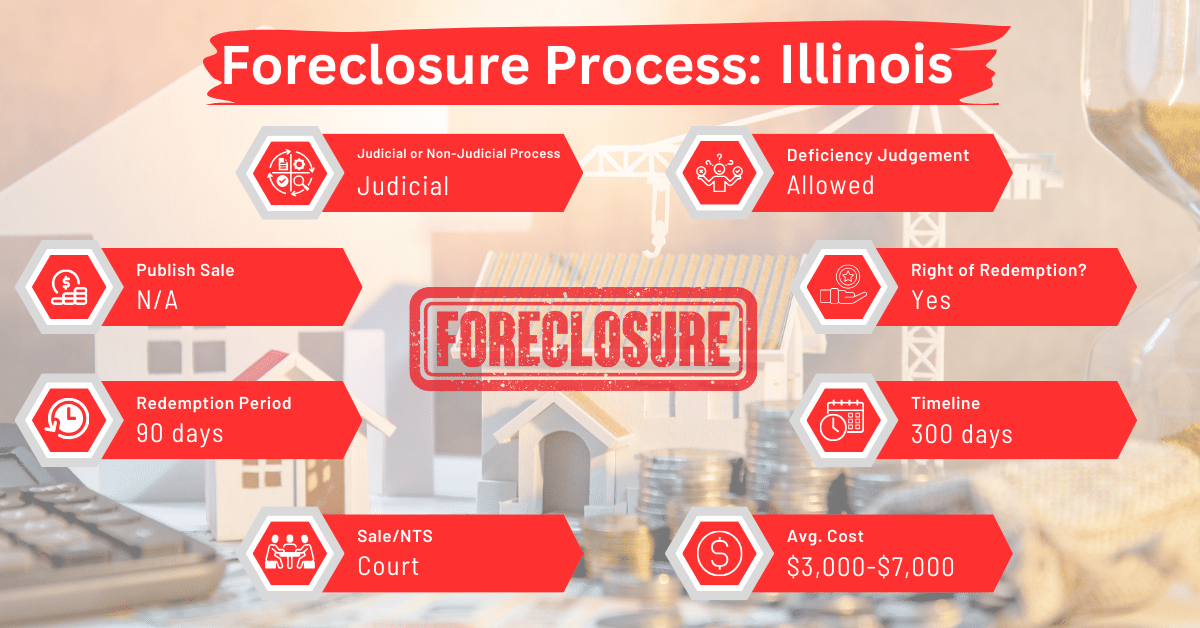

Illinois exclusively employs a judicial foreclosure process, necessitating court involvement. This process begins when a lender files a lawsuit against a borrower who has defaulted on their mortgage. The court’s involvement ensures that the foreclosure process adheres to legal standards, providing protections for both the lender and borrower.

The timeline for a foreclosure in Illinois can extend up to 300 days, which is longer compared to some other states. This extended period is due to the judicial nature of the process and includes a statutory redemption period of 90 days. The court may also extend this period in certain cases, providing additional time for borrowers to address their default.

Pre-foreclosure Period

Before initiating foreclosure, lenders in Illinois must conduct a title search to identify any senior liens and ensure that junior lien holders are named in the foreclosure suit. This step is crucial to clear the title of any liens at the time of the foreclosure sale.

Types of Foreclosures in Illinois

In Illinois, the foreclosure process is exclusively judicial, meaning it involves court proceedings. This contrasts with non-judicial foreclosures, which are not available in Illinois and are conducted outside the court system in some other states.

The judicial process in Illinois requires the lender to file a lawsuit against the borrower, and the case must go through the court system. This method provides an opportunity for borrowers to contest the foreclosure and seek legal remedies.

Notice and Sale Process in Illinois

- Initiation of Foreclosure: The process begins when a lender files a Complaint to Foreclose Mortgage in court after a borrower defaults on their mortgage payments. This legal action marks the start of the foreclosure process.

- Service of Summons: The borrower and any other defendants are served with a summons and the foreclosure complaint. Illinois law allows for service by publication if a defendant cannot be found.

- Response Period: Once served, defendants have 30 days to file an Answer with the court. Failure to respond can lead to a default judgment in favor of the lender.

- Judgment and Redemption Period: If the court rules in favor of the lender, a judgment of foreclosure is entered. Following this, there is a statutory 90-day redemption period, during which the borrower can reclaim the property by paying off the debt. The court has the discretion to shorten this period if the property is abandoned or extend it in certain cases.

- Sheriff’s Sale: After the redemption period, the property is sold at a Sheriff’s Sale. The sale date is set post the expiration of the redemption period. Notice of the sale is published in a local newspaper for three consecutive weeks, with the first publication being no less than seven days before the sale.

- Sale Procedure: At the Sheriff’s Sale, the property is auctioned to the highest bidder. The lender often provides the opening bid, usually the amount owed by the borrower.

- Confirmation of Sale: Following the sale, a Report of Sale is filed, and a Motion to Confirm the Sale is presented to the court. Once the court confirms the sale, a Sheriff’s Deed is issued to the purchaser.

- Post-Sale Rights: In some cases, the borrower may have post-sale rights, such as seeking relief if the sale price was grossly inadequate compared to the property’s value.

Avoiding Foreclosure by Selling Your Mortgage Note

One option to avoid foreclosure is selling your mortgage note to a reputable note buyer. This can provide immediate financial relief and is a viable alternative to undergoing the lengthy and stressful foreclosure process.

Borrower Rights and Protections

Illinois law provides several protections for borrowers, including the right to be properly served with foreclosure documents and the opportunity to contest the foreclosure in court. Borrowers also have a statutory redemption period to reclaim their property.

Redemption and Deficiency Judgments

In Illinois, borrowers have a redemption period of 90 days. Additionally, courts may issue deficiency judgments, holding borrowers liable for any shortfall between the sale price of the property and the mortgage balance.

Special Protections and Programs

Illinois offers various loss mitigation options and programs to assist homeowners facing foreclosure. These include loan modification programs and other state-specific assistance initiatives.

Comparative Insights

In understanding Illinois foreclosure laws, it’s helpful to compare certain aspects with other states to gain a clearer perspective on the process’s uniqueness and implications.

Publish Sale Notice

In Illinois, the notice of a Sheriff’s Sale must be published in a local newspaper once a week for three consecutive weeks. The first publication must be made no more than 45 days before the sale, while the last must be released at least 7 days before the sale.

This requirement is relatively standard, although the specific timeframes and publication frequencies can vary in other states. For instance, some states such as Alaska, Colorado, Delaware, Indiana, Nevada, and Washington, may require a longer publication period of up to 120 days. Meanwhile, states like Alabama, Arkansas, Maine, Maryland, Missouri, and Virginia may stipulate periods as short as 10 days.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Illinois, ranging from $3,000 to $7,000, are on the higher end compared to some states. This is partly due to the judicial nature of the process, which involves court proceedings and potentially legal representation. In contrast, states with non-judicial foreclosure processes often incur lower costs due to the absence of court involvement. For instance, the foreclosure cost in Arizona and Missouri is between $1,000 and $3,000. Mississippi and West Virginia follow closely, with costs ranging from $1,500 to $3,500.

Impact on Credit Score

The impact of foreclosure on a credit score is significant across the United States, typically leading to a decrease of 100 points or more. This impact is consistent in Illinois as well. However, the duration of the foreclosure process can influence the time it takes for a borrower’s credit score to start recovering.

In Illinois, the longer judicial process might mean a prolonged period before credit recovery can begin, compared to states with quicker non-judicial processes.

Conclusion

Foreclosure in Illinois is a judicial process that offers various protections for borrowers. However, it can be a lengthy and expensive. Homeowners facing foreclosure should consider all available options, including selling their mortgage notes, to avoid the negative consequences of foreclosure.