Florida Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Grasping the complexities of foreclosure laws is crucial, especially in places like Florida where distinct legal rules define the scene. In this blog post, you’ll learn a lot about Florida’s foreclosure practices, the steps leading up to a foreclosure, different foreclosure methods, and the protections borrowers have at their disposal.

Foreclosure Process Overview

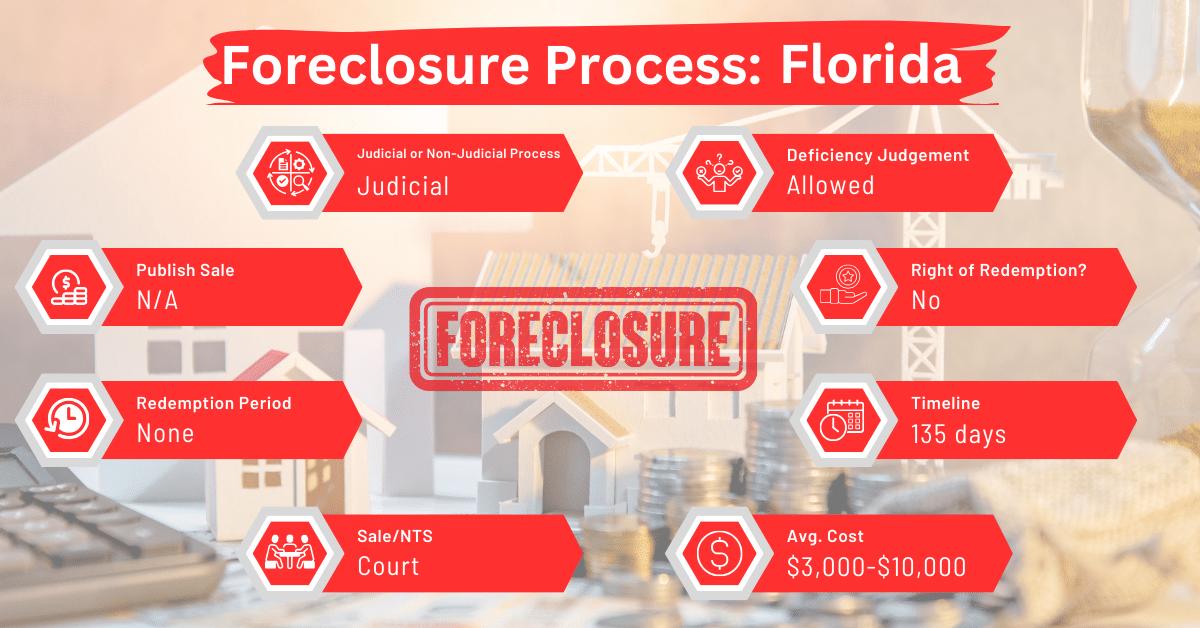

Florida exclusively employs a judicial foreclosure process, necessitating court involvement to move forward with foreclosing on a property. This process kicks off when a lender files a lawsuit against a borrower who has defaulted on their mortgage payments.

The timeline for this process averages around 135 days. This positions Florida as the third fastest state when it comes to judicial foreclosure. For context, here’s a list of other states that allow only judicial foreclosures plus their respective timelines:

- Connecticut (62 days)

- Vermont (95 days)

- Kansas (130 days)

- Nebraska (142 days)

- Kentucky (147 days)

- North Dakota (150 days)

- South Carolina(150 days)

- Louisiana (180 days)

- Ohio (217 days)

- Maine (240 days)

- Indiana (261 days)

- New Jersey (270 days)

- Pennsylvania (270 days)

- Illinois (300 days)

- New York (445 days)

Pre-foreclosure Period

The pre-foreclosure period in Florida begins with the lender filing court action and recording a notice of a pending lawsuit, known as Lis Pendens. This period is crucial for borrowers, as it offers a window to respond to the lawsuit and explore options to halt the foreclosure process, such as paying off the total amount owed.

Types of Foreclosures and Notice Process

Given Florida’s judicial foreclosure requirement, the notice and sale process is tightly integrated with the court system. A notice of sale is issued by the court clerk and must be published at least twice. The second publication should be made no less than five days before the sale date. This sale typically takes place at the county courthouse, overseen by the clerk.

Avoiding Foreclosure: Selling Your Mortgage Note

For those seeking alternatives to foreclosure, selling your mortgage note to a reputable buyer presents a viable option. This route can provide immediate financial relief and avoid the lengthy and stressful foreclosure process.

Borrower Rights and Protections

Through the Florida Fair Foreclosure Act, Florida offers several protections for borrowers, including:

- The right to contest the foreclosure in court and

- The opportunity to pay off the debt before the sale to stop the foreclosure.

Redemption and Deficiency Judgments

In Florida, borrowers typically do not have the right to redeem their property after a foreclosure sale. However, lenders may seek a deficiency judgment within one year after the sale if the sale price does not cover the mortgage balance.

Comparative Insights

Publish Sale Notice

The timeline for publishing sale notices in Florida is consistent with judicial foreclosure states, requiring at least two publications before the sale.

Costs

It costs about $3,000 to $10,000 to foreclose on a home in Florida. Compared to other states, Florida’s foreclosure costs are on the higher end, reflecting the judicial process’s demands.

Impact on Credit Score

Foreclosure negatively impacts borrowers’ credit scores across the board. Florida residents face the same potential credit score decrease as those in other states.

Conclusion

The judicial foreclosure process in Florida can be quite complicated and scary. But understanding the laws and considering all options, such as selling your mortgage note, can help you avoid foreclosure. If you’re facing foreclosure in Florida, engage with the process early and seek professional advice to improve the outcome.