California Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Overview of the Foreclosure Process in California

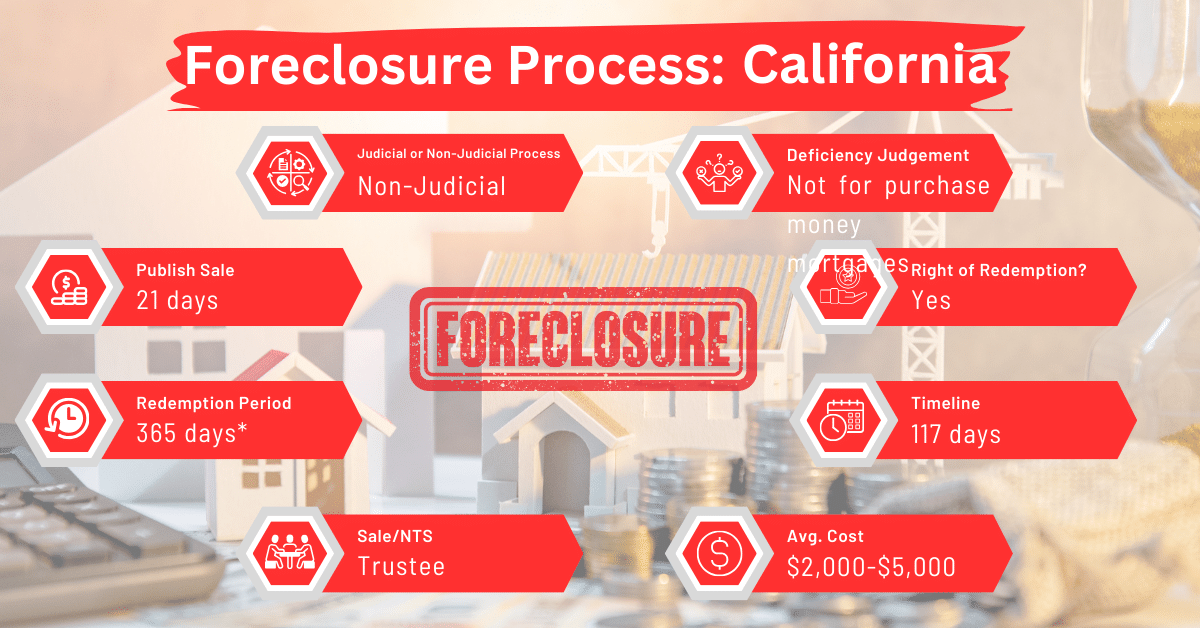

California primarily utilizes non-judicial foreclosures due to their efficiency and lower costs. However, recent updates through AB 2424 may introduce delays, such as mandatory sale postponements when the property is listed or under a purchase agreement.

Important Update: AB 2424

California’s foreclosure laws have recently been updated with the introduction of AB 2424. This legislation enhances protections for homeowners by mandating sale postponements under certain conditions, requiring properties to be sold at a minimum of 67% of their fair market value, and increasing transparency in foreclosure processes. These changes aim to protect homeowners from losing significant equity and to provide additional time to explore alternatives, such as private sales or other foreclosure avoidance strategies.

The process used to take about 117 days. However, since the introduction of AB 2424, mandatory 45-day postponements when properties are listed or under a purchase agreement can extend this timeline. The process duration places California among the states with the longest non-judicial foreclosure timelines. Among states that primarily use this method—including Alaska, Idaho, Massachusetts, Montana, and Rhode Island—California has the second longest foreclosure duration.

Pre-foreclosure Period

In California, federal law discourages the initiation of foreclosure proceedings until the borrower is 120 days past due on their mortgage loan payments. With the introduction of AB 2424, lenders are now required to provide enhanced notices to borrowers, ensuring they understand their rights, the foreclosure timeline, and available alternatives such as private sales or loan modifications. This period allows homeowners to explore loss-mitigation opportunities and foreclosure alternatives

Notice and Sale Process

The notice and sale process in foreclosure proceedings is a critical phase that varies significantly between judicial and non-judicial foreclosure states. This process is designed to ensure that homeowners are adequately informed about the foreclosure and have the opportunity to take action to prevent the loss of their property. Below, we explore the general steps involved in both judicial and non-judicial foreclosure states, with specific examples to illustrate how these processes can differ based on state laws.

Non-Judicial Foreclosure Notice and Sale Process in California

Since California is a non-judicial foreclosure state, the foreclosure process bypasses the court system. Instead of suing the borrower, the lender relied on the power of sale clause in the mortgage or deed of trust. This clause pre-authorizes the sale of the property to pay off the default loan balance in the event of the borrower’s default. Here’s a summary of how a lender may complete the non-judicial foreclosure process in California:

Notice of Default (NOD)

The lender or trustee initiates the process by recording a Notice of Default in the county where the property is located. This notice is also mailed to the borrower and any other affected parties. In California, once the borrower is 120 days past due, the lender must record a notice of default against the borrower. After the notice of default is recorded, the borrower has 90 days from the date of the recording to pay up all the sums due to the lender under the mortgage or deed of trust.

Notice of Trustee’s Sale

After 90 days, if the default is not cured, the trustee then issues a Notice of Trustee’s Sale, specifying the date, time, and place of the foreclosure auction. Under AB 2424, this process may be extended if the property is listed for sale or a purchase agreement is active, requiring a mandatory 45-day postponement to allow the homeowner additional time. This notice must be posted on the property, published in local newspapers, and sometimes mailed to interested parties. In California, the property cannot be sold until at least 20 days have passed from the time the homeowner received the Notice of Trustee Sale.

Foreclosure Auction

The sale is conducted as a public auction, where the property is sold to the highest bidder. However, AB 2424 now requires that properties be sold for at least 67% of their fair market value, ensuring that homeowners retain a significant portion of their equity. The trustee may require bidders to pay the full bid amount in cash or cashier’s check. The winning bidder receives a trustee’s deed upon sale, transferring ownership of the property.

Judicial Foreclosure Notice and Sale Process

Judicial foreclosures involve the court system and begin with the lender filing a lawsuit against the borrower. The process includes:

- Filing of Complaint and Service of Summons: The lender files a complaint in court and serves a summons to the borrower, detailing the debt and the lender’s intent to recover the property.

- Court Judgment: If the borrower does not respond or cannot cure the default, the court will issue a judgment of foreclosure, authorizing the sale of the property.

- Notice of Sale: The court orders the sale of the property, and a notice of sale is published in local newspapers, specifying the time, date, and location of the auction. This notice period varies by state.

- Foreclosure Auction: Similar to non-judicial foreclosures, the property is sold at a public auction to the highest bidder. The court supervises the auction, and the winning bidder usually must pay in cash or cashier’s check.

- Confirmation of Sale: In some states, the sale may be subject to court confirmation. If confirmed, the winning bidder receives a sheriff’s deed or similar document, transferring ownership.

Borrower Rights and Protections

Borrowers have several rights and protections, including the right to be informed of the foreclosure proceedings through proper notices and the opportunity to contest the foreclosure in judicial states. With AB 2424, these protections now include clearer communication requirements, ensuring borrowers fully understand their rights and options. Additionally, the law mandates increased transparency in the bidding process, discouraging collusion among buyers and requiring that sales reflect fair market values. California has enacted laws like the California Homeowner Bill of Rights, which prohibits dual-tracking and guarantees struggling homeowners a single point of contact with their lenders.

Redemption and Deficiency Judgments

Redemption periods and deficiency judgments also vary by state. In judicial foreclosure states, borrowers may have the opportunity to redeem their property by paying off the full amount owed. However, deficiency judgments, where borrowers are liable for the difference between the sale price and the mortgage balance, are allowed in many states but with specific limitations.

Avoiding Foreclosure by Selling Your Mortgage Note

California homeowners can avoid foreclosure by selling their mortgage notes to a reliable buyer. With the introduction of AB 2424, homeowners now have additional time to explore options like selling their properties to private buyers, ensuring they can retain more of their equity and avoid financial losses.

This can quickly ease financial stress and skip the long foreclosure process. It’s a good way to avoid problems like credit damage and losing your home. This option helps homeowners pay off their mortgage and maintain financial stability without going through the difficulties of foreclosure.

Comparative Insights

The foreclosure process, costs, and timelines vary widely across states. In California, the timeline for non-judicial foreclosures was traditionally around 117 days. However, with the implementation of AB 2424, mandatory sale postponements can extend this process, providing homeowners additional time to explore alternatives.

While states like New York still experience significantly longer foreclosure timelines due to their judicial processes, California’s recent updates aim to protect homeowners by ensuring properties are sold for fair market value and granting more time for resolution. For instance, non-judicial foreclosures in California can take around 117 days with costs ranging from $2,000 to $5,000.

This is relatively efficient and cost-effective compared to judicial foreclosures in states like New York, where the process can extend to 445 days with costs between $5,000 and $10,000.

Conclusion

California’s unique legal setup can mean longer waits in non-judicial foreclosure cases than in many other states. So, knowing the specifics can really help you navigate these tough waters. Once you understand protections and processes available in California, you’ll be able to find resolutions that are as smooth and fair as possible.