Foreclosure Overview Process in Alabama

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

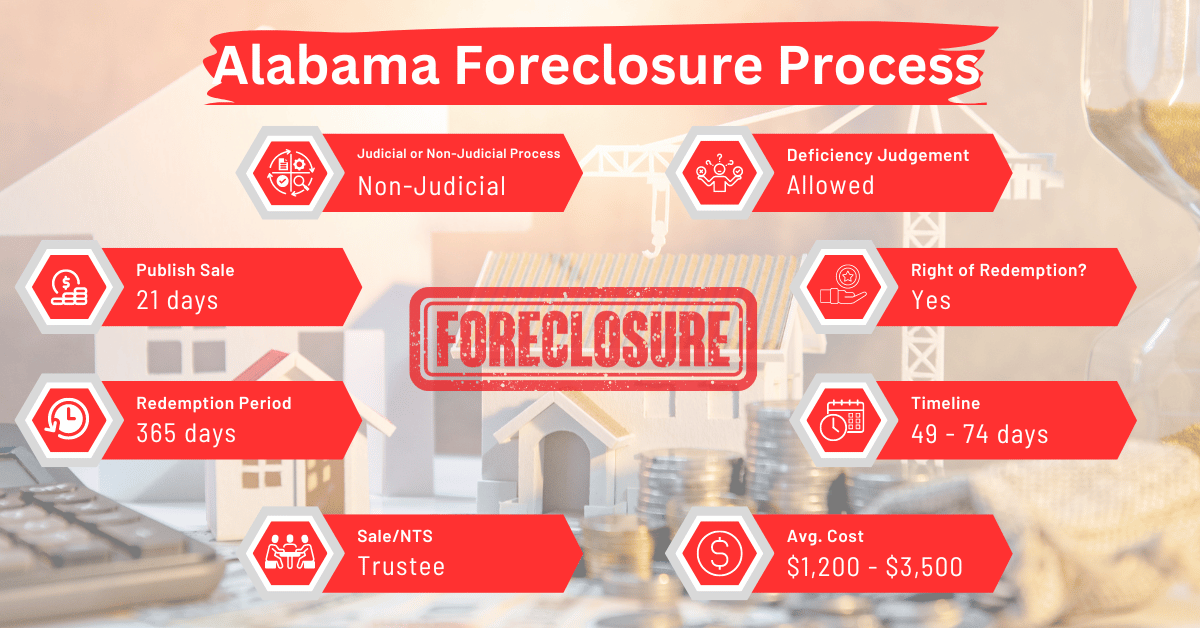

Alabama allows both judicial and non-judicial foreclosure. However, the non-judicial process is more common due to the statewide use of power-of-sale clauses in most mortgages. This means most foreclosures in Alabama occur outside of the court system after a homeowner defaults on their mortgage. Foreclosure in Alabama typically takes two to three months.

Pre-foreclosure Period

Federal laws require that foreclosure proceedings in Alabama not start until the borrower is at least 120 days past due on their mortgage payments. This period, although not officially recognized as part of the pre-foreclosure process, is crucial for homeowners who might be considering their options, including selling their property.

Alabama law does not mandate direct notice to the borrower from lenders about the foreclosure, but most mortgages require sending a breach letter to the homeowner. Also, for mortgages taken out after 2016, a notice regarding the right to redeem the property must be sent about 30 days before the foreclosure sale.

Types of Foreclosures

In Alabama, both judicial and non-judicial foreclosure processes are available.

- Judicial Foreclosure: While less common, a judicial foreclosure process is possible in Alabama, particularly if the mortgage agreement does not include a power-of-sale clause. This process involves the court system, where the lender must file a lawsuit against the borrower. If the court rules in favor of the lender, the property is ordered to be sold at auction.

- Non-Judicial Foreclosure: This is the standard process in Alabama for handling foreclosures, facilitated by the power-of-sale clause included in most mortgage agreements. The process bypasses court involvement, allowing the lender to proceed with the sale of the property after meeting certain requirements, including publishing a notice of the foreclosure sale in the local newspaper for three consecutive weeks.

Avoiding Foreclosure: Selling Your Mortgage Note

For those seeking alternatives to foreclosure, selling your mortgage note to a reputable buyer presents a viable option. This route can provide immediate financial relief and avoid the lengthy and stressful foreclosure process.

Notice and Sale Process

Alabama’s foreclosure process requires the publication of the notice of sale in a local newspaper once a week for three consecutive weeks prior to the foreclosure sale. The actual sale is conducted at the courthouse specified in the foreclosure notice. It can be held online or physically.

Borrower Rights and Protections

Alabama law gives debtors the right to redeem the property. Homeowners can redeem their property for up to one year after the foreclosure sale. However, many mortgage agreements specify a shorter redemption period. For loans originated after January 1, 2016, a shorter right-of-redemption period (180 days) may apply if certain conditions are met.

Deficiency Judgments and Special Programs

Deficiency judgments are permitted under Alabama law if the foreclosure sale price is less than the mortgage balance owed. However, for non-judicial foreclosures, the lender must file a separate lawsuit to obtain a deficiency judgment. Alabama also offers programs like the Hardest Hit Alabama Program, providing financial assistance to delinquent borrowers to catch up on mortgage payments.

Comparative Insights

Compared to other states like Illinois, where foreclosure takes up to 300 days, Alabama’s foreclosure process is relatively quick, generally taking between two to three months. The state’s preference for non-judicial foreclosures contributes to this efficiency.

Conclusion

Navigating the foreclosure process in Alabama requires understanding the distinct processes and borrower protections in place. While the state’s foreclosure timeline is shorter than in many other jurisdictions, borrowers have rights and programs available to assist them during difficult times. For homeowners facing foreclosure, it’s crucial to explore all available options, including loan modification, redemption rights, and financial assistance programs to potentially avoid foreclosure and its impacts on credit and homeownership.