Mortgage Notes & Coronavirus: Why Now Is A Good Time To Sell Or Invest

Is the right time to sell or invest in mortgage notes in the midst of the Coronavirus outbreak? We’ll cover why the virus has created such a challenging environment for traditional lending and what you can do to come out on top.

Holders and lenders that originate loans and sell that debt off on the open market are all wondering the same thing… How has Coronavirus (COVID) affected the real estate finance markets?

Before the pandemic hit, some financial experts were warning of a coming recession. Still, no one could have foreseen the immense impact that the spread of Coronavirus would have on the economy.

In particular, the primary and the secondary mortgage markets. This includes hard-money loan values trading many percentage points less than January 2020, as well as the very fast capital freeze on the entire non qualified mortgage market.

However, the unprecedented set of circumstances that the industry finds itself in today has created a uniquely well-suited environment for selling and/or investing in mortgage notes.

How the pandemic is impacting the residential loan industry

Once it was clear that the spread of Coronavirus would have a profound impact on the economy, the Federal Open Market Committee did its best to stabilize those effects by lowering the Federal Funds Rate to nearly zero. Despite the committee’s efforts, though, we’re ultimately still seeing the mortgage industry tighten up their lending standards.

Put simply, the economic uncertainty we’re facing has lenders afraid of taking on borrowers who present a financial risk. As more and more people face unemployment, traditional lenders fear rising default rates.

As a result, they’ve tightened up their standards for what it takes to be approved for a loan. In particular, they’re asking to see stable employment histories, plus lower debt-to-income ratios and loan-to-value ratios from their applicants as a measure of financial stability when they underwrite a new loan.

Risks and rewards of the future of the commercial loans

The other side of this is the commercial property finance market. Banks and lenders carry an enormous amount of loans on balance their sheets which are at risk of sustaining the most long term damage.

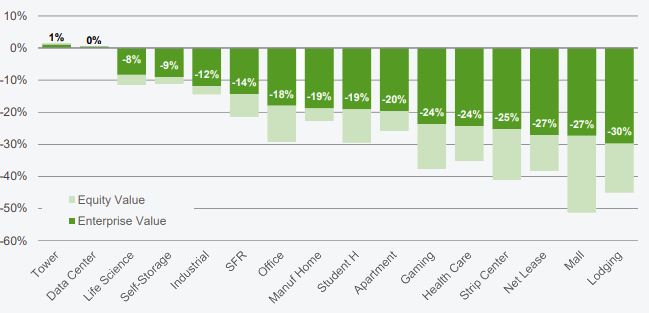

As of last quarter 98.03% of banks held commercial real estate or C&I debt. This chart shows the change in U.S. levered and unlevered values of publicly traded REITs by sector (since Feb 21).

Now, while nobody has a crystal ball, this above chart allows us to really read the terrain and predict outcomes.

Experts and Fund Managers predict moderate to significant pain felt in real estate loans attached to strip malls and retail, hospitality and lodging, office space (especially in smaller towns and cities). This may not be too apparent now but be more wide spread in the coming months.

This reset is a tremendous opportunity as the commercial side of the industry is a much more desirable investor landscape for three main reasons:

1. Commercial properties are way more malleable than residential for instance, the concept of “highest and best use” can radically change the valuation of the property

2. Second, much bigger numbers for the same amount of work

3. The regulatory environment. This is much more investor-friendly then consumer residential loan industry.

What a potentially tougher lending industry means for consumer real estate financing

In residential real estate, these tougher lending standards signify a coming buyer’s market if we are reading the terrain correctly. A buyer’s market, as you remember, is when there are fewer buyers available to compete for the homes that are currently for sale. Since there is less competition over each listing, this tends to mean lower sale prices overall.

The longer it takes to get and keep Coronavirus under control, the more likely it seems this scenario will be, especially if a depression ensues.

Even if unemployment remains low, fewer people will still not be able to be approved for a loan with a traditional bank due to other tightening measures such as higher down payment requirements or increase levels of employment verification for approval. As a result, even fewer be in the market for a home.

The solution may be seller financing the property sale

One way to increase your chances of getting an offer in this type of market as a seller is to be open to the idea of seller financing.

Seller financing, sometimes also referred to as owner financing, occurs when the buyer gets negotiates a loan for the home directly with the seller rather than a traditional bank. Instead of lending money to the borrower like a traditional bank, the property seller lends their equity in the property.

During the seller financing process, the terms for the loan – including down payment, loan amount, and loan term – are first negotiated. Then, they are recorded in a mortgage and promissory note. Over time, the buyer makes regular mortgage payments to the seller in exchange for added equity in the home.

This newly created promissory note immediately has value and is transact-able on the secondary market. Thus it has value to gain from a note sale

What to do after you have a mortgage note in hand

However, many sellers who are new to the idea of owner financing often worry about the timeframe for their return on investment with this method, They know that with a traditional bank loan they would be paid for the sale of their house in one lump sum and, in many cases, they don’t want to wait 30 years to receive their full payout.

Fortunately, there is an easy solution to this problem. You can sell your mortgage note to a note buyer. Note buyers purchase private mortgage notes as an investment and they pay home sellers in lump sums. In short, they can give you the cash flow you need to either purchase a new property or add to your net worth.

How mortgage investors also stand to benefit

On the investing end of things, this type of market suggests an incredible opportunity. As more mortgage notes are created and sold into the secondary markets, investors who are open to the idea of whole loan trading in mortgage-debt assets should find that there is suddenly no shortage of deals available, especially if they have plenty of non-borrowed cash on hand.

The bottom line

To say that Coronavirus has had an impact on the economy is an understatement. As the mortgage industry tightens up its lending standards in response to rising unemployment rates, home sellers may find themselves having to look towards owner financing as a means of making their properties accessible to more potential buyers.

Fortunately, in those situations, selling real estate notes can prove to be a profitable solution for home sellers and investors alike.