Arkansas Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

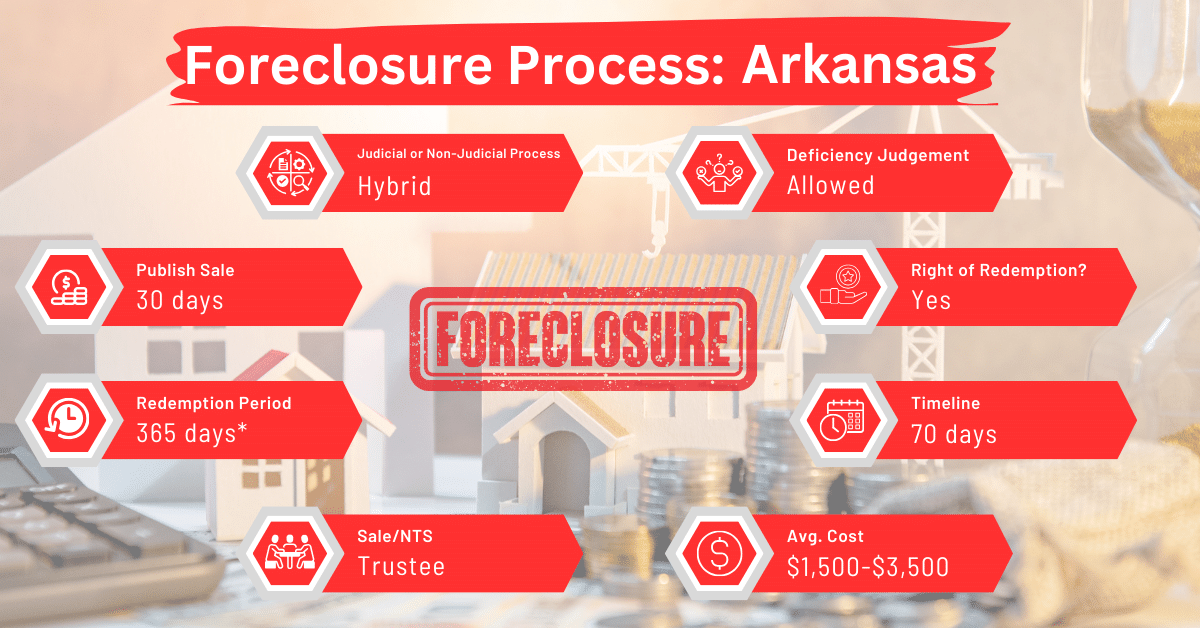

Judicial and non-judicial foreclosure processes are equally used in Arkansas. The typical duration for an out-of-court foreclosure is slightly under three months.

Pre-foreclosure Period

In Arkansas, the pre-foreclosure period is notably brief, particularly for non-judicial foreclosures. The process is initiated with a notice of default, which serves as a formal indication to the borrower that they are in breach of their mortgage terms. Once a borrower receives a notice of default, the clock starts ticking on the number of days they have to fix the default and stop the foreclosure process.

This period allows for possible loan modification, refinancing, or other arrangements between the borrower and the lender to avoid proceeding to foreclosure.

Types of Foreclosures

Like Iowa, Minnesota, and Oklahoma, Arkansas recognizes both judicial and non-judicial foreclosures. The type of process that the lender follows depends on the loan agreement and the circumstances of the default. In a judicial foreclosure, the lender must file a lawsuit to obtain a decree to foreclose.

On the other hand, non-judicial foreclosures rely on the power of sale clause in the mortgage or deed of trust. This process is faster and less costly than judicial foreclosures, but it requires adherence to strict notice requirements and procedures, including an appraisal and public notice of the sale.

Notice and Sale Process

Below are a list of regulations guiding notice and sale non-judicial foreclosures in Arkansas:

Notice

- A public notice of sale to be published in a newspaper.

- The publication must occur once a week for four weeks, with the first publication being no less than ten days before the sale.

Sale

- The sale must take place at the courthouse between 9 am and 4 pm.

- During the foreclosure auction, any person may bid to buy the property, including the lender. The trustee may also bid for the property on the beneficiary’s behalf.

- The property must sell for at least two-thirds of its appraised value. This ensures that the property is not sold for a grossly inadequate price and provides a fair opportunity for the borrower to remedy the default before the sale.

- The trustee may postpone the date of the sale by no more than seven days after the date of the original auction. What if they postpone the sale by more than seven days? Then they must start the entire non-judicial foreclosure all over again, beginning with the notice of default and sale.

- Any postponement of the sale date must be publicly announced.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Arkansas facing foreclosure can consider selling their mortgage note to a reliable buyer. This choice can help them avoid foreclosure and its downsides, like harming their credit score and losing their home.

Borrower Rights and Protections in Arkansas

Arkansas offers several protections for borrowers during the foreclosure process. These rights and protections are designed to ensure fair treatment and provide options to potentially avoid foreclosure. Some of them include:

Right to Notice

According to Arkansas Code § 18-50-104 (2020), if you’re facing foreclosure, the lender must first send you a notice of default and their intention to sell your property. This notice will include important details like the names of the parties to the mortgage or deed of trust, why the foreclosure is happening, and the lender’s plan to sell the property to recover the money owed. The lender is also required to send a certified copy of this notice to you no later than 30 days after it has been officially recorded.

Reinstatement Right

The Arkansas Code allows borrowers the right to reinstate their mortgage before the foreclosure sale by paying the past due amounts.

Redemption Rights

A borrower in Arkansas is entitled to reclaim their property after a foreclosure sale by paying the full sale price plus additional costs within 365 days.

Deficiency Judgments

Under Title 18 of the Arkansas Code 2020, the lender may file a claim for the balance of the property’s value within 12 months after the foreclosure sale if the sale doesn’t cover the full amount owed on the mortgage. To some extent, this limitation on the timeframe for the institution of legal action protects the borrower.

Legal and Financial Assistance

Legal aid organizations provide free legal services during the foreclosure process, especially to low-income families. One of such organizations is the Legal Aid of Arkansas. If you’re having trouble finding a legitimate housing counselor who’ll offer you advice on avoiding foreclosure and managing your mortgage, the U.S. Department of Housing and Urban Development (HUD) can help you get in touch with one.

Homeowner Assistance Fund Program

The Arkansas Homeowner Assistance Fund Program was launched in 2021. While it lasted, the federal government disbursed up to $40,000 to each homeowner needing help with home-related payments such as mortgages. People who benefit from the program could use the government’s financial help to pay off as much as they could of what they owed on their mortgages.

Conclusion

To sum it up, if you’re dealing with foreclosure in Arkansas, it’s really important to get a handle on the laws, which can vary a lot. Whether you’re a homeowner or an investor, you should know what rights and steps are involved, from getting initial notices to what happens after a foreclosure. Getting some legal and financial advice can really help make these challenges more manageable. The key is to stay proactive and use all the resources you have available to navigate through these tough situations.