Ohio Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

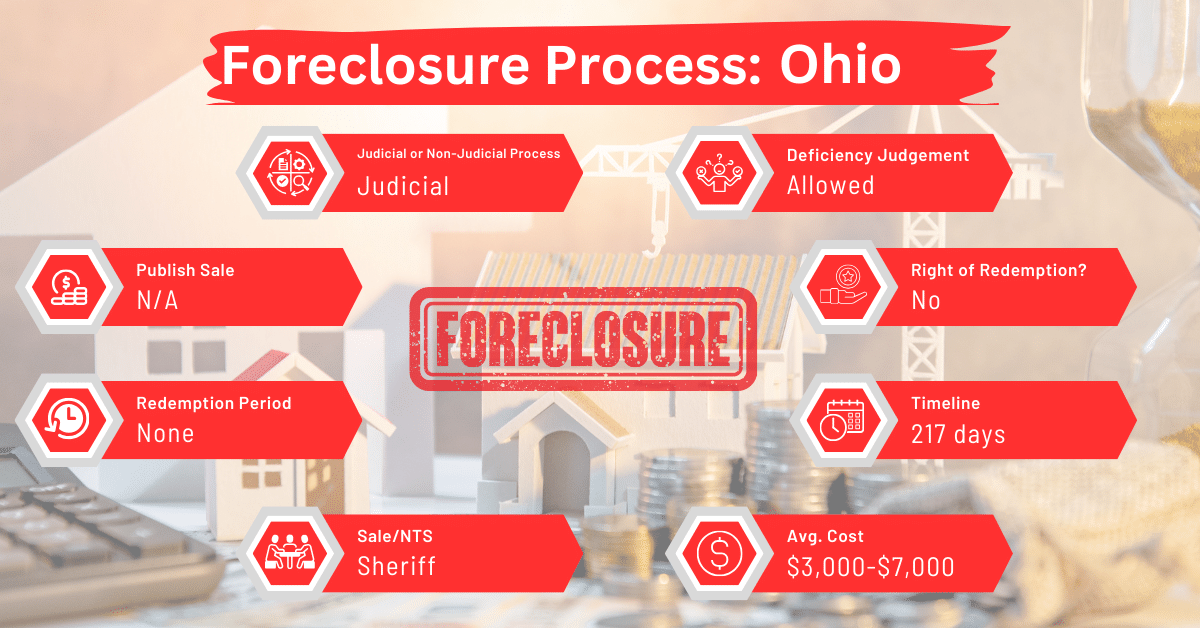

Ohio law permits only judicial foreclosures. This means that all foreclosures in Ohio are handled through the courts. This article dives deeper into the foreclosure laws and processes in Ohio.

Foreclosure Process Overview

In Ohio, the foreclosure process is exclusively judicial and typically spans around 217 days. This duration is long compared to other states, including judicial foreclosure states like Kentucky and South Dakota, and non-judicial foreclosure states like Virginia and West Virginia.

Pre-foreclosure Period

In Ohio, the pre-foreclosure period starts when the lender files court documents. The lender then notifies the borrower of this filing, typically via certified mail, regular mail, or personal service. If the borrower cannot be found, the lender may publish the notice. The borrower has 28 days to respond to this notice. If they do not respond, the court may declare them in default.

Types of Foreclosures

The Ohio Revised Code permits only judicial foreclosures. This denotes that all foreclosures in Ohio are conducted under the supervision of a court. This process starts when the lender files a lawsuit against the defaulting borrower, and the property is ordered to be sold at auction if the court rules in favor of the lender.

Notice and Sale Process

The judgment creditor seeking the sale, or their attorney, must serve a written notice to the judgment debtor and all other parties involved in the judgment. This notice must specify the date, time, and location of the sale if it is in-person, or the start date and website address if it is online. It should also include a provisional second sale date, if applicable.

At least seven calendar days before the sale, the lender must also file a copy of the notice with proof of service with the court clerk that issued the execution judgment.

It is not necessary to serve this written notice on any party who has defaulted by failing to appear in the action where the judgment was issued.

Furthermore, the officer handling the sale must give public notice in a newspaper of general circulation in the county at least once a week for three consecutive weeks before the sale date. The court may specify which newspaper to use.

The public notice must include:

- The date, time, and place of the sale for in-person auctions;

- The start date, minimum duration, and website address for online auctions;

- The deposit required

- A statement that the purchaser will be responsible for any costs, allowances, and taxes not covered by the sale proceeds;

- A provisional second sale date if applicable. However, the omission of the provisional second sale date from the notice does not invalidate the sale nor will it cause the court to vacate any sale if the property sells on the initial date.

The officer responsible for selling delinquent vacant or abandoned properties may hold an open house to allow anyone to view these properties before the sale. The officer can announce the open house in the public notice that details the date, time, and place of the sale, as required by section 2329.26 of the Ohio Revised Code. However, this officer is not obligated to provide advice about the properties to those attending the open house.

On the sale date, the sheriff conducts the public auction at the courthouse, and the property is sold to the highest bidder. The sale price must be at least two-thirds of the appraised value.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Ohio facing foreclosure can sell their mortgage note to a reliable buyer. This choice helps them get a lump sum to pay off their debt. Consequently, they may be able to avoid public foreclosure.

Borrower Rights and Protections

In Ohio, the law requires lenders to formally notify borrowers of the foreclosure to ensure they are aware of the legal proceedings initiated against them. This notification gives borrowers the opportunity to respond to the court filing and present their case or defense if necessary. Ohio law also allows borrowers the right to redeem their property before finalizing the foreclosure sale.

Redemption and Deficiency Judgments

Redemption

Before the confirmation of a sale of real estate on execution or order of sale, the debtor can stop the sale by depositing the required amount with the clerk of the court of common pleas where the execution or order was filed. This amount includes the judgment or decree total, all associated costs including poundage, and interest at a rate of eight percent per annum on the purchase money from the day of the sale until the deposit date. However, if the judgment creditor is the buyer, the interest is only calculated on the amount exceeding the creditor’s claim.

Once the deposit is made, the Court of Common Pleas will cancel the sale. It will apply the deposited funds to pay off the judgment or decree and the costs, and will allocate the interest to the buyer. The buyer will then receive the purchase money and the interest from the court clerk, and the officer who conducted the sale will return the purchase money paid by the buyer.

In auctions of residential properties seized by court order or execution, where the property is sold at a minimum bid, both the judgment creditor and the primary lienholder have the right to redeem the property. They can do this within fourteen days after the sale by paying the purchase price.

The party wishing to redeem the property must pay the purchase price to the court clerk where the judgment or order of sale was issued. Once the payment is made on time, the court will treat the redeeming party as the successful buyer.

Deficiency Judgments

In Ohio, if the sale price of a mortgaged property isn’t up to the property’s value, the lender can also sue the borrower to recover the difference. This suit is an action for a deficiency judgment.

Special Protections and Programs

The Ohio Supreme Court’s ruling in the case of Federal Home Loan Mortgage Corporation v. Schwartzwald mandated that lenders possess all necessary documentation before initiating foreclosure cases. This judgment provides some level of protection from arbitrary judicial foreclosures.

Comparative Insights

Reviewing Ohio’s foreclosure practices alongside those in other states reveals some variations in process’s duration, associated expenses, and financial impacts.

Publish Sale Notice

During the notice period in Ohio, the lender must advertise the sale in a local newspaper for three weeks. This duration is consistent with the required periods in Alabama, California, Kansas, and Rhode Island.

Costs in a Range and Comparison to Other States

Foreclosure costs in Ohio typically range from $3,000 to $7,000. These costs are influenced by the judicial nature of the foreclosure process. They’re comparable to the costs in other judicial foreclosure states like Connecticut, Illinois, Louisiana, and Nebraska.

Impact on Credit Score

Like in other states, foreclosure in Ohio can significantly affect a borrower’s credit score. It often leads to a decrease of 100 points or more.

Conclusion

For a bump-free foreclosure in Ohio, you need to understand its foreclosure laws and processes and your rights and protections. If you’re facing foreclosure, selling your mortgage note can be a viable option to avoid the process and its repercussions.