Vermont Foreclosure Process Overview

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

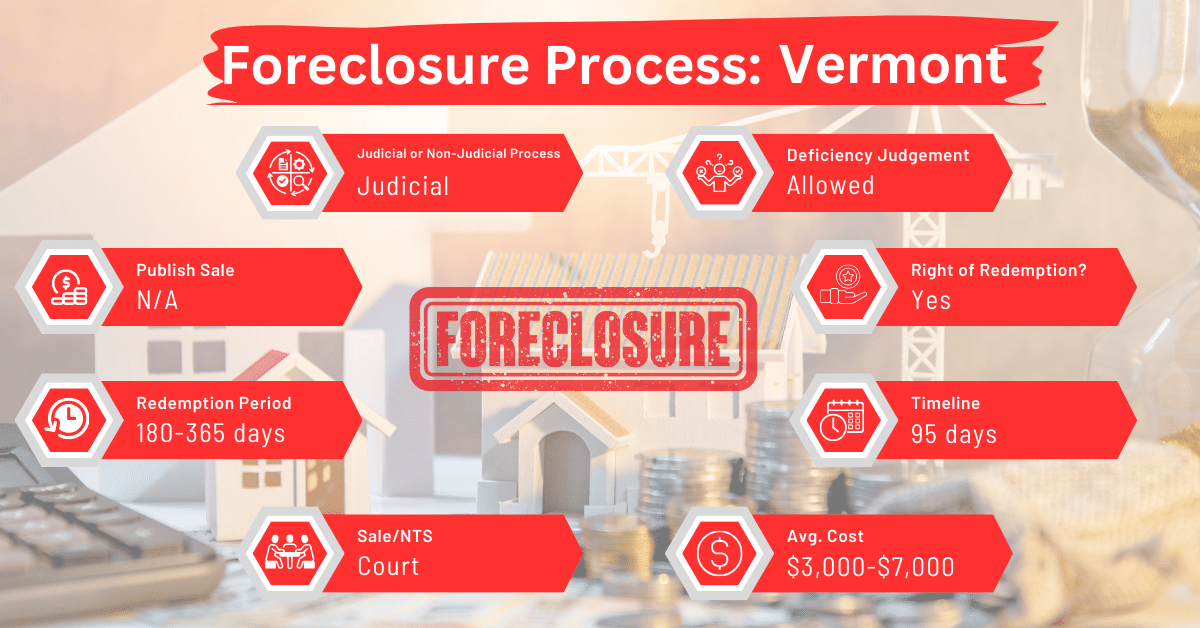

In Vermont, foreclosures may be conducted judicially or non-judicially. This means they may or may not require court involvement. The typical timeline for a foreclosure in Vermont is approximately 95 days.

This timeline is much shorter compared to states where foreclosures are mostly or exclusively judicial. For example, Delaware can take up to 210 days, Florida about 135 days, and New Jersey as long as 270 days. Similarly, Indiana has a timeline of 261 days, while Louisiana, New Mexico, and South Dakota each have timelines that can last around 180 days. Illinois and New York have even longer durations, at 300 days and 445 days, respectively.

Pre-foreclosure Period

During the pre-foreclosure period in a judicial sale foreclosure, the borrower has the opportunity to redeem the property by paying the amount ordered by the court. This pre-foreclosure period typically lasts six months, unless the court decides differently.

The duration of this period takes into account several factors, including:

- Whether the value of the mortgaged property exceeds the mortgage debt and any debts owed to junior lienholders,

- Any property taxes that have been assessed but remain unpaid,

- The condition of the mortgaged property,

- Any other relevant equities.

Types of Foreclosures

1) Non-judicial Foreclosure

In a non-judicial foreclosure in Vermont, the lender does not have to take legal action against the borrower to foreclose on the property. Instead, they can proceed with the foreclosure without court involvement by meeting the following requirements:

Notice of Intention to Sell

The notice must be sent to the borrower at their last known address at least 30 days before the notice of sale is issued. This notice should clearly state how much the borrower needs to pay to resolve their default on the mortgage, as well as the deadline for making this payment, which must be no less than 30 days from the date of the notice.

Notice of Sale

At least 60 days before a non-judicial foreclosure sale, the lender is required to send a notice of sale to the borrower. This notice must be published weekly for three consecutive weeks in a local newspaper in the county where the property is located, with the first publication appearing at least 21 days before the sale.

Up until the day of the sale, the borrower has the option to redeem the mortgage by paying off all amounts due under the mortgage, along with any expenses related to the sale.

Sale

The sale takes place right at the mortgaged property, unless the lender and borrower agree to a different location between 60 and 90 days before the sale date. The property will be sold to the highest bidder, following the terms outlined in the notice of the non-judicial foreclosure sale.

2) Judicial Foreclosure

Vermont laws recognize two types of judicial foreclosures: strict foreclosure and foreclosure by judicial sale.

Strict Judicial Foreclosure

Strict foreclosure occurs when a court issues a foreclosure decree without selling the property. This happens when the lender chooses not to request a judicial foreclosure sale. After such a ruling, the borrower has a six-month window to pay off the full amount set by the court to redeem their home.

If the borrower doesn’t manage to redeem the property within this timeframe, the lender can obtain a writ of possession from the court. This legal document allows the lender to repossess the property.

Foreclosure by Judicial Sale

When the court decides that a property should be foreclosed through a judicial sale, the lender is required to sell the property at the courthouse. At any time before the property is actually sold, the borrower has the opportunity to redeem the mortgage. To do this, they need to pay the outstanding balance due on the mortgage plus any expenses the lender has incurred while attempting to foreclose the mortgage.

Notice and Sale Process in a Judicial Foreclosure Sale in Vermont

If the borrower doesn’t manage to redeem the mortgage within the allotted time, the lender can move forward with a judicial sale of the property. To do this, the lender must first send a notice of sale to the borrower at least 30 days before the planned sale date.

In Vermont, the notice of sale will include details such as the property description, names of the lender and borrower, the date of the mortgage, and information about the sale itself. This notice must be published in a local newspaper once a week for three consecutive weeks, with the first publication appearing at least 21 days before the sale.

The sale itself is usually held right at the mortgaged property, unless the court specifies otherwise. At this sale, the property is sold to the highest bidder.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Vermont facing foreclosure can consider selling their mortgage notes to a reliable buyer. This can help them avoid foreclosure and its bad effects. Selling the mortgage note means they might get quick money to pay off their mortgage and protect their credit score.

This option is especially helpful for those having trouble with mortgage payments, as it provides a way to prevent the harmful impact of foreclosure on their finances and personal lives.

Borrower Rights and Protections

In Vermont, borrowers have the right to stop foreclosure proceedings before the sale by paying the default amount plus costs. Asides this, for strict judicial foreclosures, there is a redemption period.

Redemption and Deficiency Judgments

In Vermont, after a strict foreclosure, borrowers have 180 to 365 days to buy back their property. This time is called the redemption period and it depends on each case. If the borrower can pay the full amount the court decides, including the sale price and any extra fees, they can get their property back.

Special Protections and Programs

In Vermont, homeowners facing foreclosure have access to special protection through a mediation program. This program serves as an alternative dispute resolution method. It provides a structured environment for constructive dialogue, aiming to find mutually beneficial solutions and preserve homeownership.

Comparative Insights

This section compares Vermont’s foreclosure practices in key areas with those elsewhere.

Publish Sale Notice

In Vermont, the notice of sale must be published at least 21 days before the sale date. When compared to other states like Montana, Indiana, Colorado, Nevada, and Delaware, this requirement is extremely favorable to the lender.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Vermont range from $3,000 to $7,000. This range is relatively high when compared to some other states including Arizona, New Hampshire, Missouri, Rhode Island, Texas, and Wyoming. These costs can include legal fees, publication costs, and other administrative expenses involved in the foreclosure process.

Impact on Credit Score

Foreclosure universally impacts credit scores across all states, typically leading to a decrease of about 100 points or more. This negative effect is consistent in Vermont and remains on a credit report for 7 years. However, the impact gradually diminishes over time, especially if proactive financial management and good credit habits are maintained.

Conclusion

For homeowners in Vermont facing foreclosure, understanding these laws and processes is vital. Selling the mortgage note can be a viable option to avoid foreclosure. It’s important to consider all available options and seek professional advice to navigate these challenging situations effectively.