West Virginia Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

In West Virginia’s beautiful hills, those having trouble paying their mortgages often worry about losing their homes to foreclosure. This article explains the rules and steps of foreclosure in West Virginia clearly. At the end of this post, those that foreclosure may affect will have a better idea of how to navigate the process.

Pre-Foreclosure Period in West Virginia

When a borrower misses their payments for five days, the lender is required to send them a notice of default. The borrower then has ten days from the date the notice is sent to catch up on the missed payments. If they don’t manage to do so, the lender can move forward with the foreclosure process.

That being said, borrowers only receive a notice of default for their first three missed payments. After that, if they miss payments again, the lender can start the foreclosure process without sending another notice..

Types of Foreclosures in West Virginia

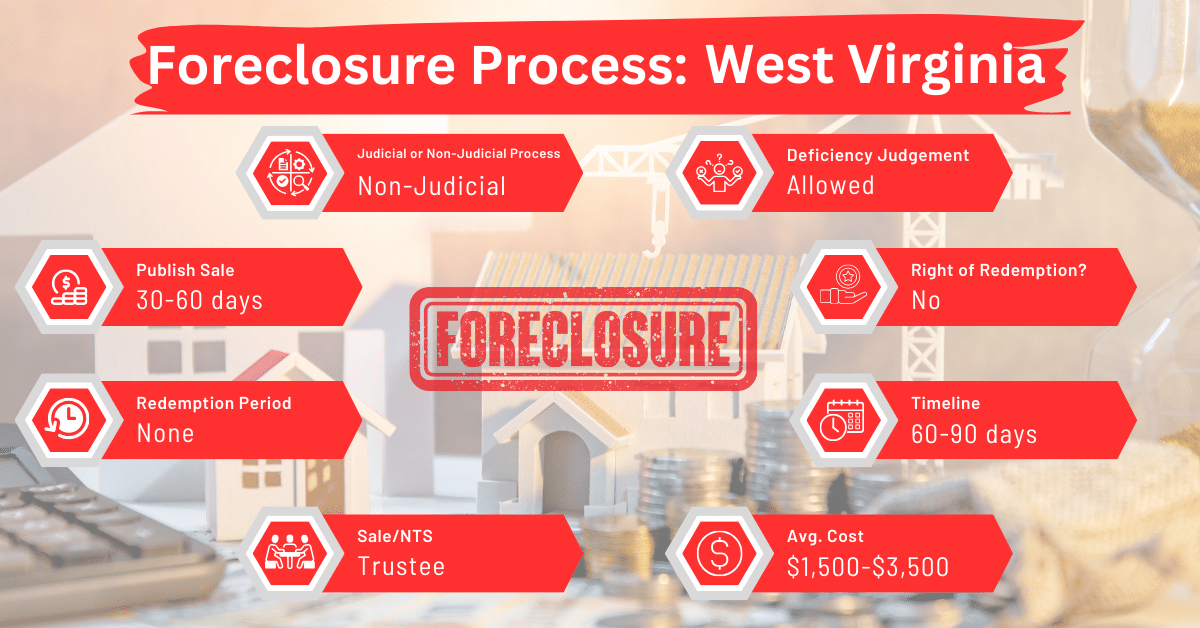

West Virginia allows for both judicial and non-judicial foreclosures. The choice between these methods depends on the terms of the mortgage or deed of trust. Judicial foreclosures involve court proceedings and are generally used when a power of sale clause is absent in the loan agreement. Non-judicial foreclosures are quicker and involve a trustee who can sell the property without court intervention.

Notice and Sale Process in West Virginia

According to West Virginia’s laws, the lender is required to notify the borrower of their intention to sell the property within a reasonable time. Once the lender has mailed the notice of sale to the borrower, they’re regarded to have done everything necessary to notify the borrower.

After mailing the notice, the lender must publish a notice of sale once a week for two weeks. Some trust deeds require up to four weeks of publication. At least 20 days before the scheduled auction, a copy of the notice of sale must be mailed to the borrower and junior lien holders. Foreclosure sales are conducted as public auctions, with the property sold to the highest bidder.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in West Virginia facing foreclosure can consider selling their mortgage note to a reliable buyer. This choice can help them avoid foreclosure and its downsides, like harming their credit score and losing their home.

Borrower Rights and Protections in West Virginia

West Virginia offers several protections for borrowers in the foreclosure process, such as:

- The right to a notice of default

- The right to a notice of sale

- The right to reinstate the mortgage before foreclosure.

Redemption and Deficiency Judgments in West Virginia

In West Virginia, there is no statutory redemption period following a non-judicial foreclosure sale. However, lenders may allow for a redemption period voluntarily. Additionally, lenders may pursue deficiency judgments if the sale price does not cover the mortgage balance.

Special Protections and Programs in West Virginia

In West Virginia, there aren’t any special state programs or extra protections for people facing foreclosure. The state only provides the usual legal steps and basic rights for all borrowers.

This means homeowners in foreclosure have to depend mainly on these standard rules and their basic rights, without any extra help or specific programs from the state.

Comparative Insights

This section provides a detailed comparison of foreclosure processes in West Virginia with those in other states, focusing on the duration for publishing sale notices, associated costs, and the impact on credit scores.

Publish Sale Notice in West Virginia

In West Virginia, the duration for publishing a sale notice ranges from 30 to 60 days. This is notably longer than in states like Alabama, Georgia, Tennessee, Texas, Virginia, and Wyoming, where the non-judicial process is much quicker.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in West Virginia typically range from $1,500 to $3,500. This is relatively lower compared to states like New Jersey and New York, where foreclosure costs can escalate up to $10,000. The lower costs in West Virginia are due to the shorter, non-judicial process, which avoids the lengthy and costly court procedures prevalent in judicial foreclosure states.

Impact on Credit Score

A foreclosure can lead to a decrease of 100 points or more in credit scores across the United States. The impact of foreclosure on credit scores in West Virginia is consistent with the national trend.

Conclusion

Navigating West Virginia’s foreclosure laws and processes requires an understanding of the state-specific nuances. For those facing foreclosure, selling the mortgage note can be a viable option to avoid the process and its negative consequences.